|

|

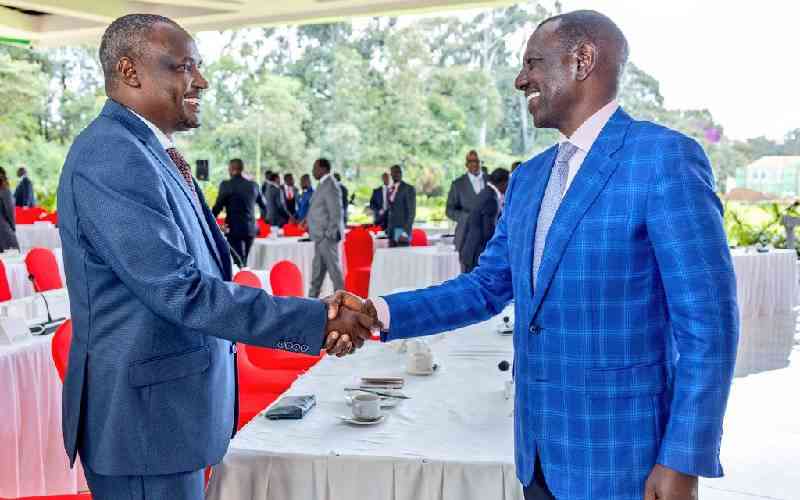

From left, Changamka CEO Sam Agutu, Britam Regional Director Stephen Wandera, Safaricom CEO Bob Collymore and Britam Group MD Benson Wairegi at the launch of the Linda Jamii product Wednesday. |

By Jevans Nyabiage and Emmanuel Were

Kenya: On Friday, Safaricom shares touched an all-time high of Sh12.80.

The mother of all stock market questions is whether the stock that started trading at the Nairobi bourse more than five years ago has the momentum to get to Sh15 in the coming weeks, if not days.

If Safaricom hits Sh15, it will have risen six times since its lowest ebb in early 2009, when it traded at Sh2.55 — half its 2008 initial public offering price of Sh5.

Then investors were fearful, now they are greedy.

So what is it really about Safaricom that is driving the share price? And is this the best time to cash out?

In answering these two questions, it is important to understand what Safaricom really is. Or even what maybe Safaricom is not and will likely become in the next few years.

For those old enough, it will be nostalgic to remember the fortunes of the national airline Kenya Airways, whose share price rose 14 times in three years. And plunged.

Insurance

Last week, when Safaricom touched its all-time high, the mobile phone services provider waded into insurance, completing its presence in financial services.

The insurance sector, which has just about four in every 100 people on a medical or personal cover, is currently where the banking sector was two decades ago.

Opening an account with a bank was for middle and high-income earners with white-collar jobs in the 90s.

That was until Equity Bank turned the industry’s thinking on its head by targeting low-income earners.

Now Safaricom, in partnership with Britam and Changamka, wants to do the same with the provision of medical insurance.

Medical insurance — for a family of three — will cost Sh12,000, which is about five times less than what you would get from some of the top providers.

Stay informed. Subscribe to our newsletter

It is not that there are no other providers providing cheap medical insurance.

The deposit-taking microfinance Faulu Kenya has such a cover, as does Equity bank.

But the difference is the verve and vigour with which Safaricom and its senior management will push this product to get to at least one million customers this year.

And also, of course, is the fact that the insurance product will be advanced through M-Pesa, giving about 18.2 million customers access to it.

“At one time, my domestic worker fell ill and we had to rush her to the hospital. I was shocked by the bill that came a few days after,” said Safaricom CEO Bob Collymore at a cocktail during the launch of the Linda Jamii product.

“Many people from abroad have been calling me to find out about the insurance product.”

Outside the box

What is coming from the people at Safaricom is that the firm is willing to innovate in the provision of medical insurance in far-flung places.

Take, for instance, pastoral communities whose wealth is stored in cows.

Safaricom wants to create an economic model that will allow these communities trade in their cows and in exchange get medical insurance for their families, according to people familiar with the concept at the company.

This would, in essence, be going back to the good old days of barter trade.

If it is successfully pulled off, then other companies might even just copy paste the model in the push for businesses in counties that were forgotten but are now being seen as ripe with potential following the discovery of their mineral wealth.

Safaricom has become omnipresent; it is in banking, insurance, health, music, sports, agriculture, with some taking to calling it the “new government”.

Safaricom also plans to go into TV. These days you can watch your favourite English Premier League games at Sh60 on your mobile phone through a partnership Safaricom has with DSTv, the pay tv provider. This is cheaper than buying a soda in a bar to watch a game.

It is the telecom firm’s strong financial performance, diversification into data and killer app M-Pesa — the mobile money transfer service that has changed the banking scene — that have seen the stock start to rally.

More than 60 per cent of Kenyans are now using mobile phones to do their banking, creating room for the company to generate more cash, according to a survey by the Kenya Bankers Association.

Boasting about 20 million subscribers, the telco has managed to attract and retain customers despite increased competition from Airtel, Orange Kenya and yuMobile.

The operator has upped its ante to grab a large share of the data business, investing more on fibre with a Sh10 billion war chest.

The current rally is good news for shareholders who have patiently watched the share fluctuate in the market.

Going by the Sh12.45 price at which it closed last week, Safaricom’s capitalisation — which is the total value of investor funds — jumped to Sh498.56 billion from a low of Sh102.1 billion in 2009.

Total market capitalisation stood at slightly above Sh2 trillion, meaning Safaricom’s stock controls a quarter of the total shareholder wealth at the Nairobi bourse.

Strong fundamentals

Mr Eric Musau, an analyst at Standard Investment Bank, says the rally in the share price has been mostly due to the impressive half-year results announced by the company in November, as well as strong fundamentals.

“The first half numbers are still a catalyst … the company fundamentals also appear good given the information that we have,” he said.

Safaricom, East Africa’s largest telco, posted a 45 per cent growth in half-year results to register a net profit of Sh11.3 billion.

Its profits grew 39 per cent year on year in full-year results reported in 2013.

Mr Kuria Kamau, an analyst at Kestrel Capital, says the stock’s performance is driven by three factors. First, the company’s financial performance.

“You’ll struggle to get any other company that has managed to grow profits by the same amount during the same period,” Mr Kamau says.

Second, he says, is the stimulus programme in the US.

“The US government has pumped in a lot of money in America that has found its way into stock markets across the world, including Kenya.

“If you look at stock markets across the world in 2013, they all performed extremely well. Safaricom is the most active stock traded by foreign investors and as a result, it has benefited the most from the US stimulus programme.”

Driving foreign investor interest in Safaricom is the fact that the firm has proven that mobile money payments and transfer services are profitable and can be scaled up.

Thirdly, Kamau says, is momentum.

“When a stock rises significantly, some investors start to buy the stock to try and take advantage of the rise. By buying the stock, they actually push the price even higher. It’s kind of like a self-fulfilling prophecy.”

Mr Aly Khan Satchu, an investment analyst, says Safaricom has been in a bull trend for more than 24 months.

“The powerful bull move in January 2014, which was achieved on muscular volume, was a consequence of continued strong international demand for the share based on a rock solid and gilt-edged dividend policy [which has already been signalled to go higher], outstanding cash generation, and of late, I feel an increasing awareness that data is all set to turn parabolic,” he said.

Mr Satchu is of the opinion that the use of data — which includes browsing and Internet downloads — is set to rise sharply as more people get into smartphones and embrace the culture of apps.

No threat

Some analysts have argued that Safaricom’s share valuation should look beyond telecoms and include the financial services segment.

This is a question Mr Collymore faces whenever he meets with analysts from Europe and America: Is Safaricom a bank or is it a telecom?

Mr Musau, the analyst from SIB, says financial services is an important growth area for Safaricom but he does not think it is worth more than its core voice, data and SMS business.

“If you look at the split in revenue, you will understand why. The financial services division is also EBITDA margin dilutive, but now profitable and an increasing important component not only for loyalty but also bottom line,” he said.

EBITDA — which measures a company’s operational performance — is an alphabet soup meaning earnings before interest, tax, depreciation and amortisation.

This is usually a good measure for telcos because of the high depreciation and amortisation charges they face from investing billions in equipment, which they need to replace in a few years.

Musau says it is difficult to benchmark the financial services division of Safaricom with that of a commercial bank.

Some components are similar, especially when you look at the non-funded element. This includes fees and commissions charged.

For the funded component, the bank gets deposits and lends out, keeping the margin.For mobile money, the savings and lending component is still done by banks, with the telco earning a commission for making it easy for the bank to access the customer.

“I see lots of scope on the payments side, particularly pushed by Government payments. As Safaricom has the customer, partnerships with banks will be something we will continue to see.”

Alternatively, an audacious move by Safaricom would be to by a bank.

One investment banker was of the opinion banks could buy telecoms or vice versa because the mobile phone has pretty much evolved into a bank branch.

“Just imagine if they came up with a mobile phone that you could transact all your banking services — from an app to do interbank transfers and all the other services. You wouldn’t have to go to the branch,” he said.

“Every mobile phone has now become like a branch of a bank. Imagine if Equity Bank bought Airtel. Or what if Safaricom bought a bank?”

All the other telecoms — Airtel, Essar and Orange — have struggled in the Kenyan market with losses and the need for more capital injection from their shareholders.

If they continue losing money, an option for these telecoms would be falling into the hands of banks. This would be a very strategic acquisition for the big banks with a heavy retail presence.

Every mobile phone would become a branch, and banks would be able to push financial services onto their customers, from stocks and insurance products to investment products in the capital markets.

Analysts remain bullish about Safaricom’s prospects, attributing their confidence to the firm’s dominant position and diversification of earnings.

The telecoms share price has been performing well in the past 12 months and is the most improved share price in the Nairobi Securities Exchange.

Some analysts expect the share to continue rallying in the short term and may hit an average of Sh13.50.

“I am confident that Safaricom is headed to 13.50 ahead of the final year earnings release in April,” said Satchu.

However, Musau said: “I am still reviewing the stock, but I think it will not go substantially beyond the current levels.”

And for Kamau: “I believe that the company’s prospects are very good and I see no reason why it should not get to Sh15. How soon it will get there is very difficult to say.”

Going forward

The biggest asset for the mobile operator is its innovation machine.

M-Pesa has become the latest push around mobile payments and it is giving the mobile operator a headstart into e-Commerce.

A massive Sh94.8 billion of real-time payments are made through M-Pesa per month, with the service having 11.55 million 30-day active customers in the period ended September 30, 2013.

The recent introduction of Lipa na M-Pesa will likely be a hit in 2014. It enables cashless merchant payments.

And already, Safaricom is poised to be the biggest beneficiary in the new regulations that will ban cash fare payments from July 1, 2014.

The operator says it has signed up 1,300 public transport vehicles and taxis to its Lipa na M-Pesa platform.

Safaricom is said to be working on a number of innovations in the public sector transport space, some on its own and others with partners such as Google.

The telco’s stock is not the only listed one to suffer from such a long lull in the activity of its shares.

National carrier Kenya Airways’ stock remained battered for some time when its share dipped and stagnated for close to eight years. The stock finally took off in 2003 after which it has been among the best performing at the NSE, reaching an all-time high of Sh140 in 2005 — a stark contrast to their lowest level of Sh10 in 2002.

Safaricom shareholders’ fortunes now seem to be looking up for a stock that for the past four years has performed dismally.

Rough start

At the time of listing on June 9, 2008, Safaricom introduced 10 billion shares to the NSE out of the 40 billion issued shares, in a move meant to ensure that shares of the operator, then majority owned by the State, were spread to more Kenyans.

There was optimism and a lot of excitement. This was the largest IPO in Kenya’s history, seeing an oversubscription of 532 per cent from both local and international investors.

It was historic for its sheer scale and massive oversubscription.

In its early years of trading, the stock didn’t perform to the expectations of investors. On its first day of trading, many had predicted the share price would double the IPO price of Sh5, but to their surprise, it only managed Sh7.35.

That year, the share would only touch a high of Sh7.90. It is the same year that it dropped below its IPO price.

On February 27, 2009, the share touched an all-time low of Sh2.55, sending the company’s market value plummeting.

The stock grossly underperformed in the initial years of trading at the bourse, forcing many to cut their losses and sell their shares at below the offer price.

But, in many instances, the option to sell was limited in the past five years, during which the stock traded below Sh5, and flirting with the Sh2 mark for while. It is from last year that the share regained momentum to trade above Sh5.

The huge volume of Safaricom shares available in the market has been partly blamed for the sluggish appreciation of the stock. The company at some point considered share consolidation.

[email protected]

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.