By MACHARIA KAMAU

KENYA: Little known oil exploration and production companies that acquired land in Kenya’s oil blocks are finding themselves increasingly spoilt for choice on who to partner with.

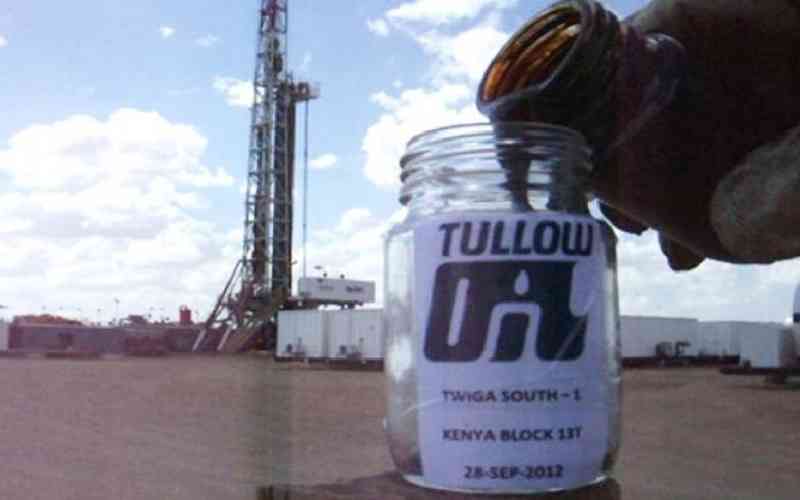

Since Tullow Oil announced in March last year that it had found shows of oil in its Ngamia 1 well, as well as later discoveries, firms that took up exploration licences are being courted by major production and private equity firms.

At the Oil Council World Assembly in London in November, Susan Prior of PricewaterhouseCoopers noted that there was an increased flow of private capital into exploration activities as investors look for alternative opportunities.

“We are seeing more private money come into upstream deals, which is often the combination of high net worth individuals or people with access to private capital that want to start exploring oil exploitation opportunities,” she said.

“A combination of factors is triggering this, and one of them is the amount of capital that is out there that is looking for a productive home. There are also people that are realising that though upstream is a risky place to be, if you are sensible about it and you spread that risk, you can get good returns.”

Big leagues

Among the junior oil firms that seem positioned to hit the big leagues are Taipan Resources — a Canada-based oil firm that operates in Kenya as Lion Petroleum Corp.

The company on Thursday announced the completion of a Sh2.6 billion farm-out agreement with Premier Oil Investments. A farm-out deal is an arrangement where the holder of mineral rights gives a second party an agreed interest in its exploration activities in exchange for a sum of money.

In the deal, Premier acquired 55 per cent participating interest in Block 2B in North Eastern Kenya. Taipan retained 45 per cent interest and operatorship during the exploration phase of the block.

Premier will finance Taipan’s exploration to the tune of Sh2.5 billion and also pay Sh85.8 million in back costs, which will help Taipan recover some of the money spent on initial exploration.

“[Premier’s financing] will enable us do more surveys and also drill a well in the third quarter of next year that will go to a depth of 3,000 metres,” said Taipan Chief Executive Maxwell Birley.

Drilling and testing

“This includes the drilling and testing of a Pearl-1 prospect that is estimated to have gross resources of 200 million barrels of oil. The remaining inventory on Block 2B, in addition to Pearl-1, is capable of delivering in excess of 500 million barrels gross.”

The Pearl-1 site — on Block 2B — is along the same geological formation as Tullow Oil’s discoveries.

Stay informed. Subscribe to our newsletter

“The Anza Basin is one of the largest tertiary-age Rift basins of the East African Rift systems that together contain multi-billion barrel oil discoveries. We believe that the ‘sweet spot’ of the Anza Basin is located on Block 2B,” said Mr Birley.

The firm also expects to drill its first well in Block 2A towards the end of next year.

“We do not have people running around throwing money at us, people will only invest if they believe in the management team and the prospects,” said Birley.

“We have been able to convince a number of companies that we are on the right track and a number of companies have technically approved farm-ins to our licences.”

Simba Energy, another Canadian headquartered firm with exploration blocks in several African countries, including Kenya, said it is working with individual investors, private equity firms and major oil companies.

“We have seen that the most successful way is to bring in a private equity company or high net worth individuals who can invest between $2 million (Sh171.6million) and $10 million (Sh858 million) in specific exploration projects. It is a model that has worked for us in Kenya and Chad,” said Mr Oleg-Serguei Schkoda, vice president of exploration at Simba Energy.

Mr Schkoda, also speaking at the November Oil Council conference, noted that exploration firms have been having difficulties raising money from shareholders, necessitating the need to attract private equity and major exploration and production companies.

Raising money

“We are talking to larger companies on different projects, but it has been quite difficult to raise money from the capital markets. Our experience is that small companies should start exploration, show the potential and make it interesting for the independent companies to bring the exploration to the second stage,” he said.

Simba Energy’s chief executive of production, Mr Hassan Hassan, said the firm has been getting a lot of interest from global companies after it moved its block in the Anza Basin from the preliminary phase.

However, despite there being many suitors, not all are willing to part with the millions of dollars required for exploration, particularly with commercial viability yet to be established.

Simba Energy last week Wednesday announced the collapse of talks with American company Ajax Exploration. It was hoped the firm would finance Simba’s exploration with Sh3.1 billion in a farm-out deal that was to be firmed up before the end of this year.

The firm said in an update on December 18 that it is now in negotiations with an undisclosed company for a farm-out agreement that would push forward prospecting activities at its Block 2A site.

Another junior oil company that has been prospecting for oil in Kenya, specifically in Lamu, is Australian Far Limited.

The firm has previously carried out seismic surveys and estimates that its block might contain more than 300 million barrels of oil. It plans to start drilling in 12 to 18 months’ time.

Far is currently firming up financing deals with a number of companies that have expressed interest in its activities.

[email protected]

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.