×

The Standard e-Paper

Kenya’s Boldest Voice

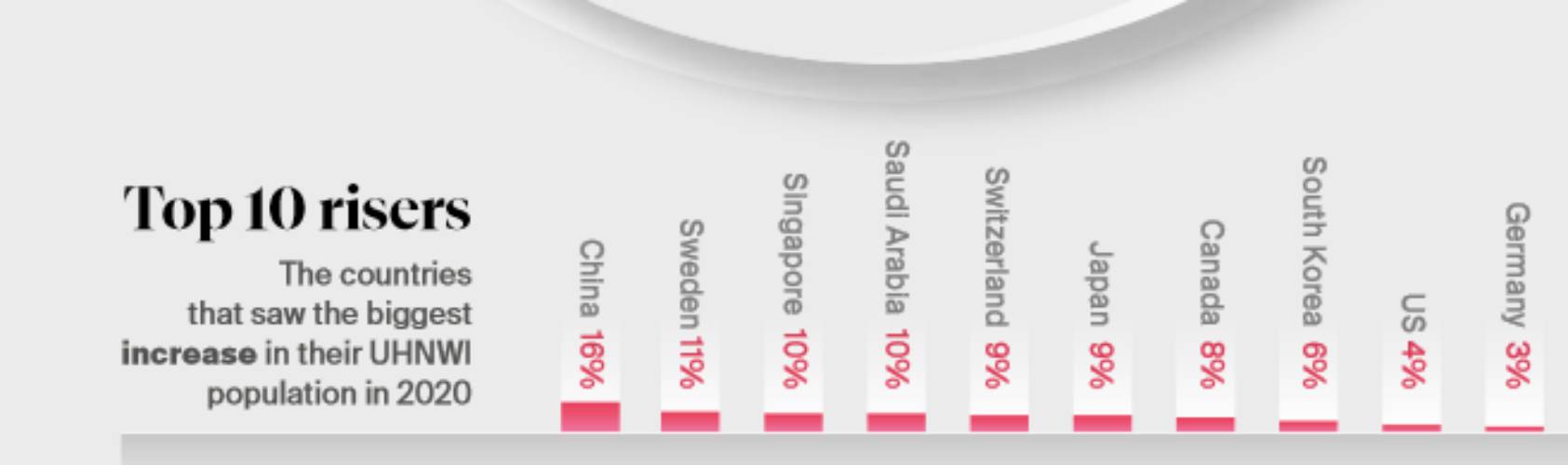

Kenya’s population of High-Net-Worth Individuals slipped by 22 per cent last year, a new survey reveals.

According to Knight Frank survey, High-Net-Worth Individuals (HNWIs) are those worth over Sh108 million (one million US dollars)