×

The Standard e-Paper

Home To Bold Columnists

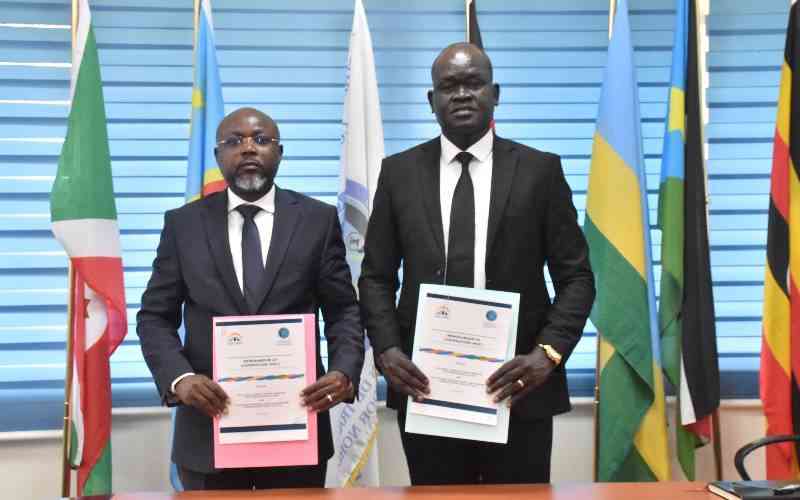

Africans have been urged to embrace the use of digital currencies in order to accelerate the economic recovery in the continent occasioned by the coronavirus pandemic.