×

The Standard e-Paper

Stay Informed, Even Offline

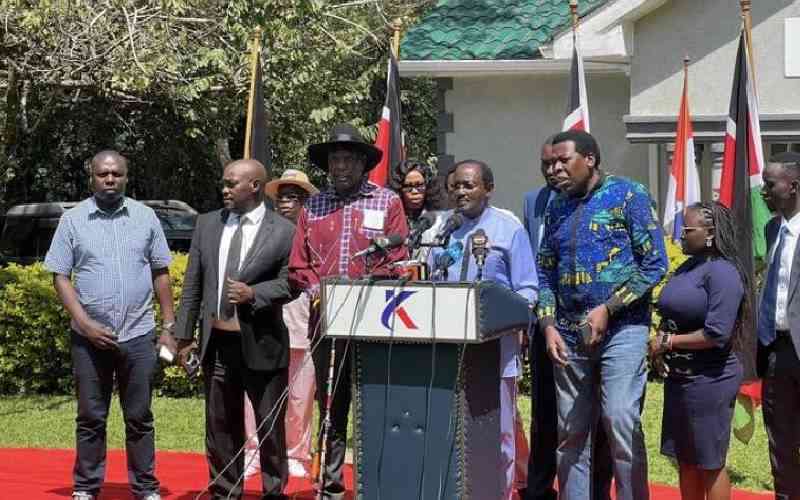

President William Ruto's most ambitious budget has hit headwinds with the Catholic Church and the opposition rejecting it arguing that the proposed taxes were oppressive and would hurt the hustlers.

The Catholic bishops and Azimio la Umoja Coalition leaders separately accused the government of betraying the people by formulating the Finance Bill and the Budget Estimates which were oppressing Kenyans.