×

The Standard e-Paper

Join Thousands Daily

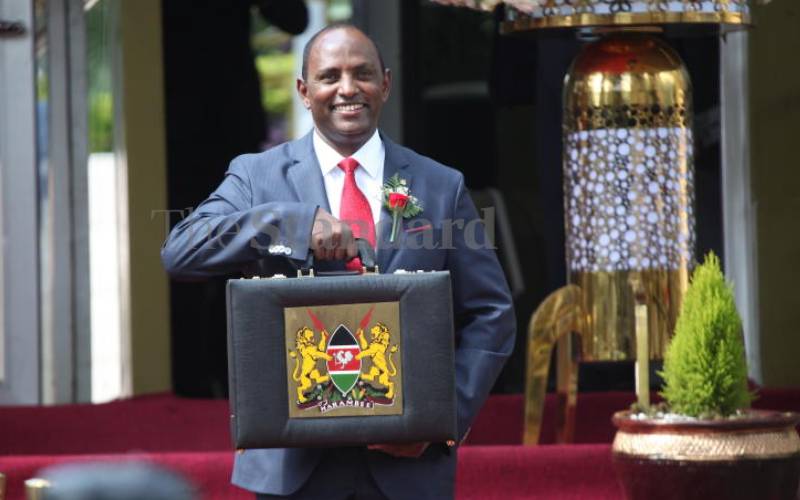

CS Ukur Yatani at The National Treasury, June 2020. [Wilberforce Okwiri, Standard]

On April 7, National Treasury Cabinet Secretary Ukur Yatani will read his last Budget under President Uhuru Kenyatta’s administration and with only four months before the August 9 General Election.