Ethiopia has suspended bids for a second telecommunication licence that was to include mobile money, stalling Safaricom’s quest to launch M-Pesa in the country.

The Ethiopian Communication Authority (ECA) said through a notice dated December 22 that it had cancelled the plan to offer the new telecoms licence following requests from interested parties.

“ECA received concerns and requests from several prospective bidders to delay the process and issue the request for proposal (RFP) at a convenient time in the future, which the authority fully concurred with,” it said.

“Accordingly, ECA has suspended the RFP process for the new second licence and will relaunch the process in the near future.”

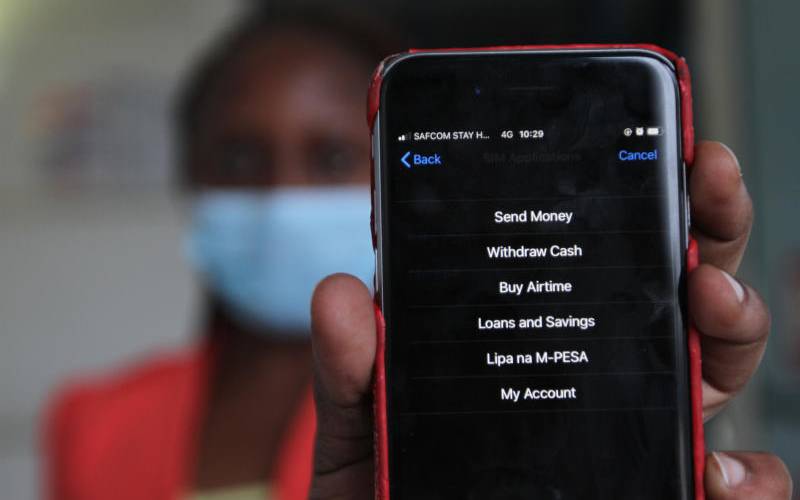

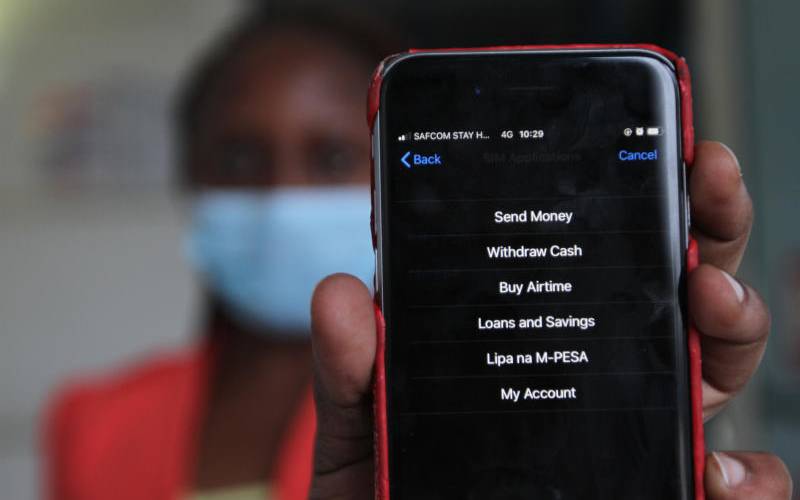

The suspension means Safaricom, which plans to launch in Ethiopia early this year, will only compete with Ethio Telecom, but potentially faces delays in rolling out M-Pesa since the licence did not include mobile money.

ECA’s initial plan was to issue the second licence by end of this month after going through bids that would come from international and national telecommunications operators.

The delay comes on the back of Safaricom writing to ECA seeking clarity on conditions it would be required to fulfil to be cleared for mobile money.

Safaricom Chief Executive Peter Ndegwa in November last year said the telco was awaiting response from ECA, including if it will be required to add some fees to get a mobile money licence.

The Safaricom-led consortium, which includes Vodacom and Vodafone, was in May last year granted a telecommunication licence for Ethiopia following a USD850 million (Sh96.3 billion) bid.

Ethiopia’s only telco, Ethio Telecom, launched mobile money in May last year, with Prime Minister Abiy Ahmed saying mobile money would be open to other telcos within a year.

Safaricom sees the Horn of Africa country that boasts of about 50 million phone subscribers as having great potential for M-Pesa services.

Adding mobile money to the already awarded telecommunication licence would enhance the opportunity for Safaricom to break even faster and grow its net profit beyond the Sh68.67 billion posted in the year ended March 2021.

Ethiopia has a population of over 112 million people, making it the second largest country in Africa by population. M-Pesa would be expected to thrive given the large population that is unbanked.

The Ethiopia market had largely been closed to external investors but the government started relaxing the stance in 2019 through an economic reform agenda, with the support of the International Finance Corporation.

The government has embarked on liberalising the economy with reforms such as granting licences to foreign mobile network operators and sale of a stake in Ethio Telecom seen as the initial steps.

However, the civil war in Ethiopia has caused a setback to the pace of economic reforms with investors monitoring the situation closely.

Safaricom has had to evacuate staff from Ethiopia and resort to remote working in what could delay its launch unless the security situation improves.

[email protected]

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.