×

The Standard e-Paper

Stay Informed, Even Offline

The Fuliza overdraft service transacts more than Sh1.2 billion daily. [File, Standard]

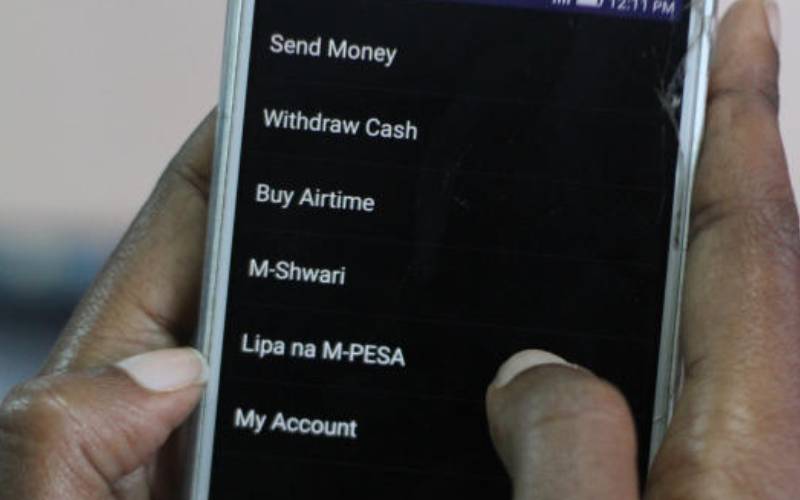

Safaricom’s mobile overdraft service Fuliza now rakes in more revenue for the telco than its mobile lending service M-Shwari, less than three years after Fuliza’s launch.