×

The Standard e-Paper

Join Thousands Daily

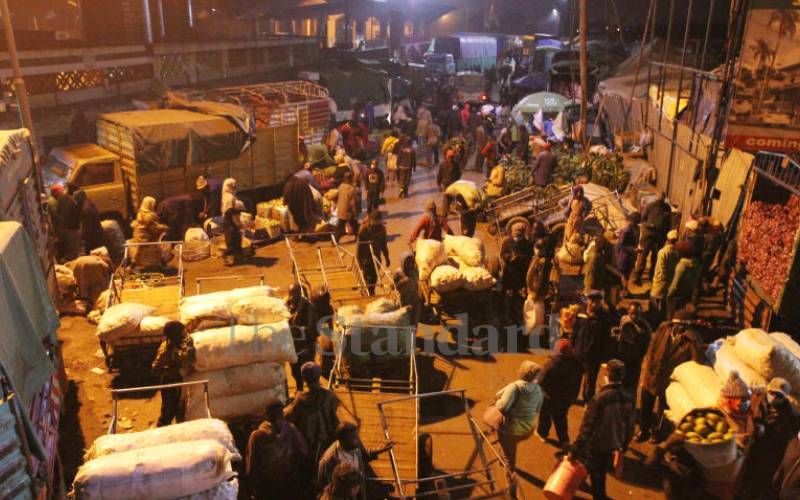

Traders at Marikiti market, Nairobi. [Elvis Ogina, Standard]

Financial sector players, including banks, Saccos, insurers and digital lenders expect a continued rebound in 2022 pegged on improving economic activities amid persisting Covid-19 infections.