×

The Standard e-Paper

Join Thousands Daily

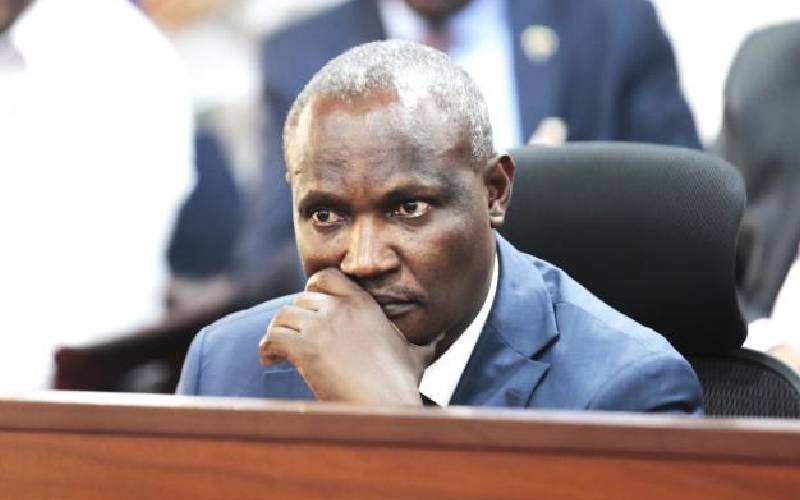

When newly elected President of the Democratic Republic of Congo (DRC) Felix Tshisekedi arrived in Nairobi in 2019, few people understood the importance of his first official state visit.

It came two weeks after Tshisekedi’s inauguration in the country’s first peaceful transition of power in more than five decades.