×

The Standard e-Paper

Kenya’s Boldest Voice

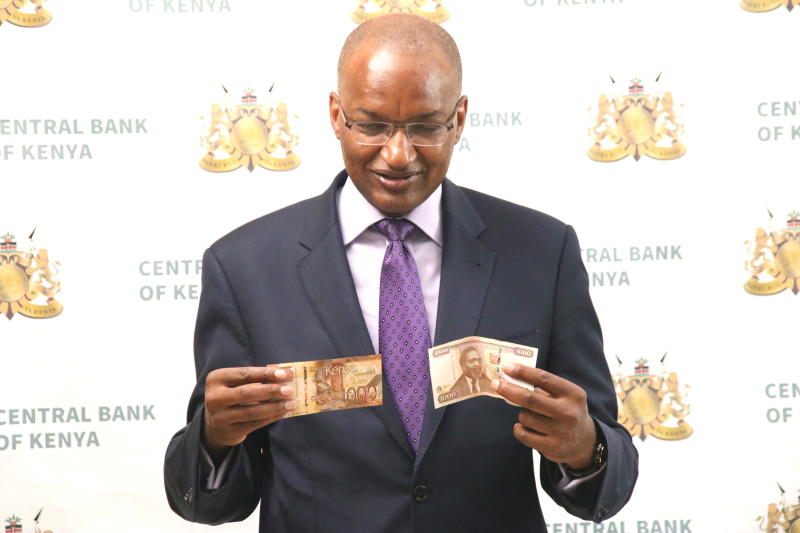

Central Bank of Kenya Governor Patrick Njoroge holds the new 1000 shilling note with the old note during the media briefing on the new currencies notes [David Gichuru, Standard]

“Thanks to your hard work and commitment, our shilling has remained fairly stable and competitive.”