×

The Standard e-Paper

Fearless, Trusted News

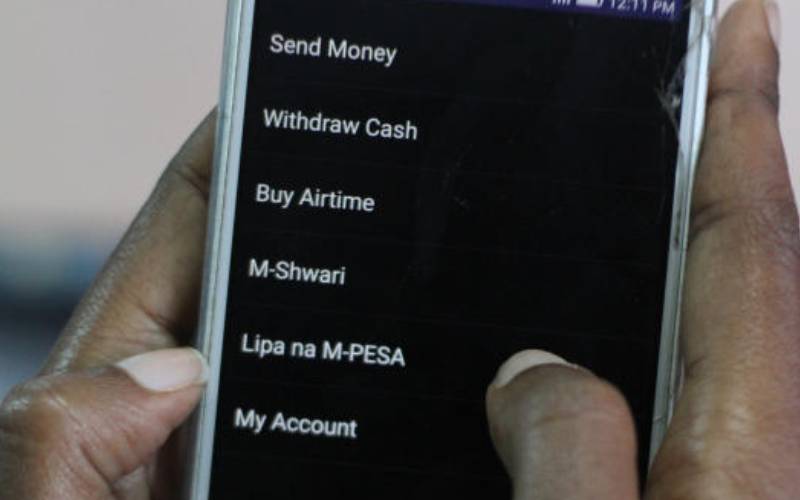

Safaricom’s overdraft facility, Fuliza, has taken less than three years to capture the digital lending market.

But the telco’s climb to the pinnacle of the market segment has been anything but smooth.