Several decades ago, banks were chasing after customers by establishing a network of branches in as many places as possible. But the tide has turned now.

Banks are now de-emphasising the brick and mortar banking and following customers to the digital platforms. While this is touted to be the silver bullet to enhance profitability and efficiency, it has also come at a cost to workers.

Many players in the industry are now cutting jobs to drive down the cost of doing business. In the banking halls, the place where customers used to flock, is getting deserted. And banks are reacting by cutting down on staff numbers.

Banks are readjusting their positioning in the market and more trends are likely to shape the sector. They are taking a prudent approach in their financial books to reflect that they had extended high risk credit and calculated against high interest expected. With the interest rate cap, most lenders have continued to increase provisions for bad loans.

Banks are falling over each other to announce staff cuts across the sector blaming it on a tough year which has seen most leading banks make huge profits.

The country’s biggest lender by assets, Kenya Commercial Bank Group (KCB) led the pack with Sh15.9 billion net profit trailed closely by Equity Bank Group with Sh15.1 billion and Co-operative Bank with Sh10.5 billion for the nine months to September 30. Barclays Bank made a net profit of Sh6 billion.

Even before the lenders ran into headwinds of capped interest rates, they had started cutting staff numbers. In the Central Bank of Kenya supervisory report that reviewed the year 2015, banks had cut their workforce by 700. Sidian Bank, which recently announced that it would reduce its workforce by 108 employees said it is looking at using technology more to deliver services to customers.

Rendered redundant

Equity Bank said some 400 of its employees had left the bank over the last year and it would not be making intensive recruitment but would also be investing in technology as well as its agency banking network. “Of course you should not expect massive recruitment,” CEO James Mwangi said at an investors briefing on the day he announced the lender’s third quarter results.

Family Bank and First Community Bank are also downsizing. The two lenders, having faced reduced earnings and rising bad loans, have not specified how many of their workforce will be sent packing.

Standard Chartered also plans to lay off about 600 workers. The lender last week announced that 300 staff would be rendered redundant with the closure of its Nairobi shared services centre, whose functions have been transferred to India.

Ecobank, which operates in 36 countries, has also announced plans to reduce the number of its physical branches in Kenya by a third.

The closure of the nine branches, the bank’s head of commercial banking in East Africa Humphrey Muturi, said was to follow customers to digital platforms to enhance efficiency. This could see hundreds of staff rendered redundant.

“In the event that some of them [employees] may not get these opportunities, we will treat them with dignity and in a humane way as we allow them to transition to the next phase of their careers,” he said last month.

Cooperative Bank has been implementing its e-transformation strategy with emphasis on lean workforce that has seen it thin staff from 4,000 in 2014 to the current 3,600 through retrenchment and natural attrition. The lender knew this early. This is how: If you walk into a Co-operative Bank branch, it will likely take you under 10 minutes to deposit a cheque or cash into an account.

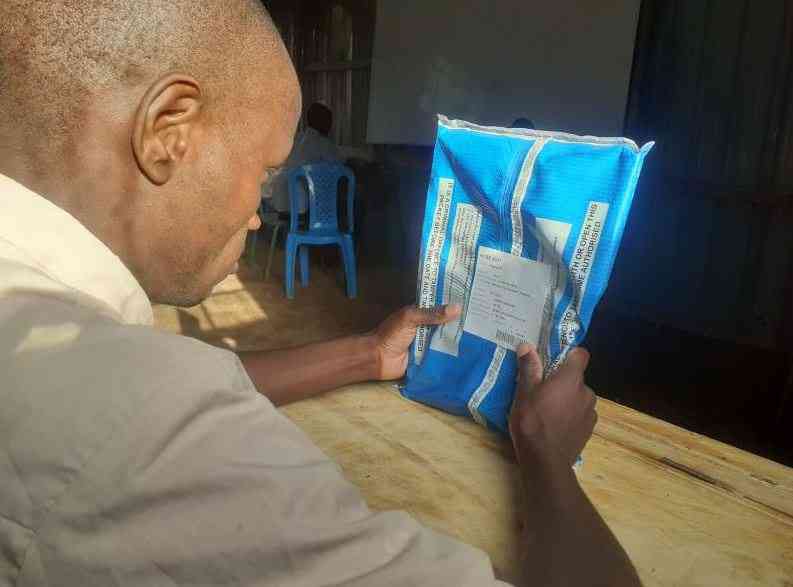

The cash deposit, furthermore, will not be handled by an employee of the bank. Instead, it will be received by an agent of the bank, who will deposit it into an account using a hand-held device similar to the point-of-sale machines used to swipe credit and debit cards in retail outlets, like coffee houses or petrol stations.

The agents are independent of the bank, and are given only a desk to work from and earn their commission. Co-op Bank does not pay their salaries, which means it makes significant savings on staff costs and related expenses. The lender’s aggressive cost-cutting strategy and its push towards paperless banking started in August 2014 through a transformation project dubbed ‘Soaring Eagle’.

Consulting firm McKinsey & Company advised the bank on this strategy. Last week when it announced its nine-month financial results, it had pulled ahead of the rest. It registered a 22 per cent jump in net earnings in the third quarter of its current financial year. In terms of growth, this was the highest so far. Equity Bank grew its net profit by 18 per cent while KCB’s was up 15 per cent.

However, as the wave of panic among employees flows in the banking sector, unions say they will not roll over and take the retrenchments lying low. Banking, Insurance and Finance Union official Pius Mtemwa says the announcements have only been made on newspapers and they would wait for official notices to take the matter to court. “We are waiting for them to engage us through a formal letter that can be challenged legally. We cannot wage war without a notice,” Mr Mtemwa said.

He said that banks have been avoiding open confrontation by asking staff to leave voluntarily and looking for any slight mistake to reduce staff. Uncertainties around the interest rate cap has brought in a crisis, and as true masters of the trade they do not let a crisis go to waste.

Interest Capping

The banks would have the economy believe that the coming into effect of the interest capping regulations has been critical in ending their party, which has in the past been seen in super normal profits posted by banks.

Historically, the lending institutions have always sustained high profits even during harsh economic times when players in other sectors have had to contend with declining profits and a number of them reporting losses. Backed by analysis that spells gloom, the lenders are using the pitfalls of the law to implement a change in the banking model that has been long overdue.

“In terms of financial performance, the picture isn’t looking rosy for 2017. We expect profit before tax to retreat as banks take haircut on their toplines-specifically income from their loan books,” George Bodo Head of banking research, Ecobank Capital, said.

What is emerging is a deliberate effort to outsource staff and deploy technology to reduce the human resource that cost banks salaries, which are bargained upwards by unions every other year. This year alone, the indications are that the industry will cut a record number of jobs. Different lenders have announced initiatives that have led to the loss of about 1000 jobs in just three months, up from the 700 jobs lost in 2015.

But even with the shedding of jobs, all the top three profitable lenders have not managed to stop staff costs from growing. KCB’s third quarter results show that its staff costs hit Sh10.32 billion, up by 16 per cent.

For Equity Bank, the costs rose marginally by 2.76 per cent to Sh6.32 billion even though the CEO attributed that to 20 per cent pay rise. Cooperative bank saw its staff costs surge by 17.6 per cent to Sh6.34 billion while for Barclays Kenya, it went up by 5.6 per cent to Sh7.37 billion.

Mobile banking

Taming wage bill in the banking sector to retain high margins, seems to be the new obsession in the sector. “Banks are shutting down risky SME and consumer products. Products such as unsecured personal lending have been shut down; same goes to unsecured working capital financing for SMEs. All the personnel associated with those products-business originators, credit analysts as well as branch support-all have to go. Hence the lay-offs,” Mr Bodo said.

Apparently, the new bank employee is that mama mboga and kiosk guy next to your house with a point-of-sale machine who does not cost the bank a shilling and has actually acquired enough efficiency to replace the teller. “You do not have to worry about what happens to your money once you have given the agent. The transaction is complete within 30 seconds,” Equity Bank’s CEO said when he launched digital wallet to support over 10 banking applications.

According to a Moody’s report that proposed the new model last year, banks of the future need to expand agency network, build the financial literacy of mobile banking users and extensively invest in product research, development, marketing and distribution. Mobile banking technology has allowed lenders to target new customers directly with minimal transaction and overhead costs and without an extensive network of branches. Banks are also able to boost their revenues by offering users access to a wider array of banking products on the mobile platform.

This, banks are beginning to believe is the way to boost cost to income ratio, which shows how much an organisation receives as revenue for every shilling spent.

For Equity Bank, it now spends Sh49 cents to earn one shilling, an improvement from 53 cents. It is betting on digital offerings to improve it further to 42 cents in just three years. “We may sell a few,” Mwangi responded recently when asked about the future of his large branch network that once served to his advantage, helping Equity to grow customer base quickly.

On Kenyan market, KCB spends just 43.5 cents to make one shilling. This is an improvement from 49 cents in the third quarter in 2015. During the investor briefing during the release of the third quarter results, KCB boss Joshua Oigara told investors that he is banking on technology to improve efficiency and sweat the bank’s assets enough. “We are investing in a completely new platform for mobile money services and it will be up in six months,” he disclosed. According to the Central bank of Kenya (CBK), lenders signed up almost four thousand agents in the first half of this year who helped them lend out Sh1.6 trillion by June.

According to the 38th Monetary Policy Statement published by Treasury in the Kenya Gazette last week, Banks contracted 43,675 active agents who facilitated 386.4 million by June 2016. This was a significant increase from December 2015 when the number of agents stood at 39,754, and the cumulative transactions at 221.6 million valued at Sh1.2 trillion-being more than half the money the Government wants to spend in the current financial year.

CBK noted that agency banking has been rapidly expanding with a total of 17 commercial banks having been licensed by the regulator to undertake the service by June 2016. “The mobile phone continued to be an important platform for financial services thereby reducing transaction costs,” CBK said. Mobile money transactions were estimated at Sh9 billion per day in May 2016 compared with Sh8.6 billion in December 2015.

Technology-led delivery channels have continued to facilitate an increase in access to financial services while allowing banks to offload staff and branch network in favour of independent agents who are reaching even more clientele.

A Moody’s report last year, Banks and Sovereigns – Sub-Saharan Africa Mobile Phone Banking Supportive of Economic Growth and Banking Sector Prospects, showed that while the number of physical banks and staff has grown by less than a third, the number of customers shot over the roof.

One employee now serves an average of 770 customers, while in 1996 the same employee was serving an average of 60 customers.

In Kenya for instance, the number of deposit account holders increased from 1 million to 28.4 million between 1996 and 2004 while the number of bank branches increased to 1,443 from 538 (2.7 times). Also the number of staff increased to 36,923 from 16,673 (2.2 times) during the same period.

Old model Taxi

Aly-Khan Satchu, the CEO of Rich Management says this digitisation of banks and use of new channels to reach customers are playing a critical role in rendering banking halls and tellers irrelevant. He said more banking personnel in the country are going to lose their jobs in the coming months.

“The well-known Economist Joseph Schumpeter characterised this kind of moment as one of ‘creative destruction’. I might characterise it as when the Banking sector got ‘uber’ed. Running an old model Taxi firm in the age of uber is not optimal and banks are at the same point. Lots more layoffs to come I am afraid,” he said.

Banks have even decided to bring in the agents into banking halls something the union is fighting hard. “You cannot outsource your core business, I think we have a case in court with Barclays. You cannot replace tellers and bring in agents into banking halls who are not pensionable or enjoy the other benefits,” Mr Mtemwa said.

KCB has an emergency system that brings in agents incase branches are overwhelmed to deal with crises and reduce pressure but some see it as a way of testing whether this new ‘uber-model’ will carry banking away from tellers tomorrow.

Equity Bank’s boss believes that the era of competing on prices is over now and that it may take something else to sing into the hearts of customers.

“Price has ceased to be competitive. May be we can now compete on risk,” he said adding that customers are more than before concerned about safe channels and hence declared death on physical money.

The party may be over but workers are worried of what next will be struck from the menu. With the latest returns up to September having tested just 16 days of lending under capped interest rates, KCB’s Oigara reckoned that the next results may give a clear picture on where banks stand.

Even in the changing times, bankers’ actions point to executives who have fixed their eyes on financial statements. They are not about to let go of the high profits even in the new environment.

—Reporting by Macharia Kamau, Otiato Guguyu and Patrick Alushula

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.