×

The Standard e-Paper

Kenya’s Boldest Voice

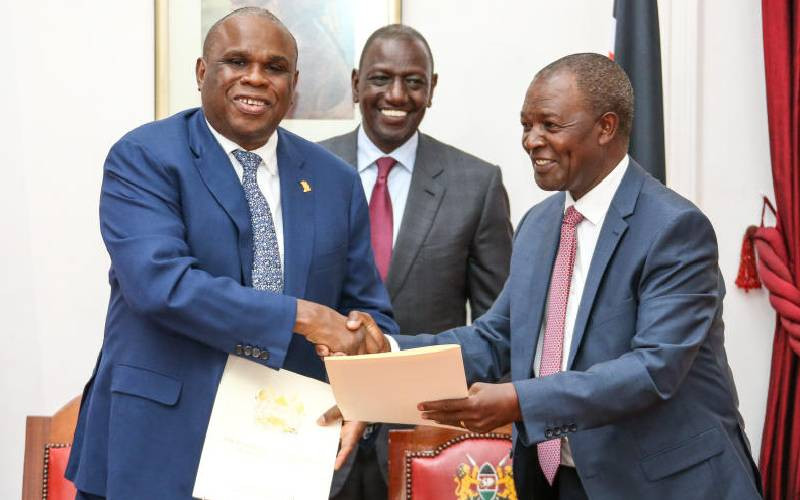

President William Ruto has said Kenya will rally for a Pan-African payment system that will allow transactions across markets regardless of currency differences.

The move, the Head of State said, will enable Kenya, and the rest of the African countries to maximise trade opportunities that exist under the African Continental Free Trade Area (AfCTA).