×

The Standard e-Paper

Home To Bold Columnists

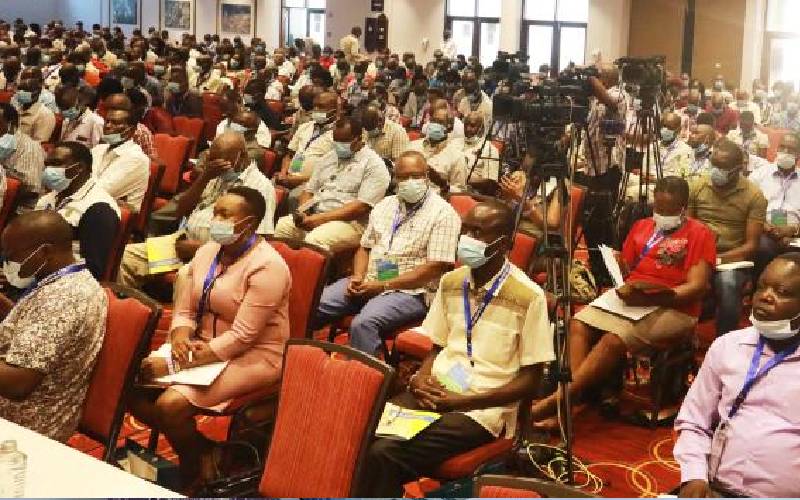

Delegates follow a session during Kenya Union of Savings and Credit Co-operatives limited's (KUSCCO Ltd) 6th Annual Sacco Leaders Convention at Pride Inn Shanzu in Mombasa County on Tuesday 23rd February 2021.[Kelvin Karani, Standard]

Government and private sector firms are holding onto Sh4.3 billion of their employees’ Sacco deductions, which has crippled the societies’ operations.