×

The Standard e-Paper

Smart Minds Choose Us

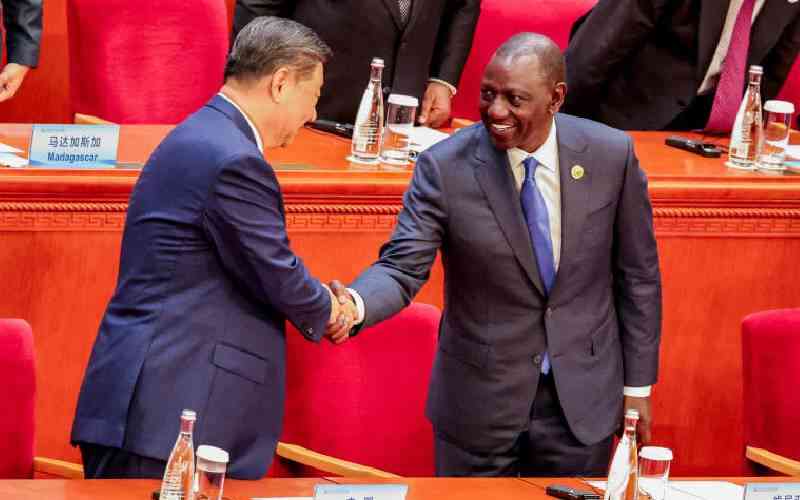

Chinese investors are gearing up to establish manufacturing industries worth billions of shillings in Kenya and other African countries.

Through the African Chapter of the American Chinese CEOs Society (ACCS) launched in Nairobi on Friday, the investors said they will engage Kenyan companies' executives and decision-makers as an entry point to establishing more manufacturing companies in the country.