×

The Standard e-Paper

Smart Minds Choose Us

In a move to bolster economic stability and enhance debt sustainability, the National Treasury has announced a strategic shift in its borrowing approach.

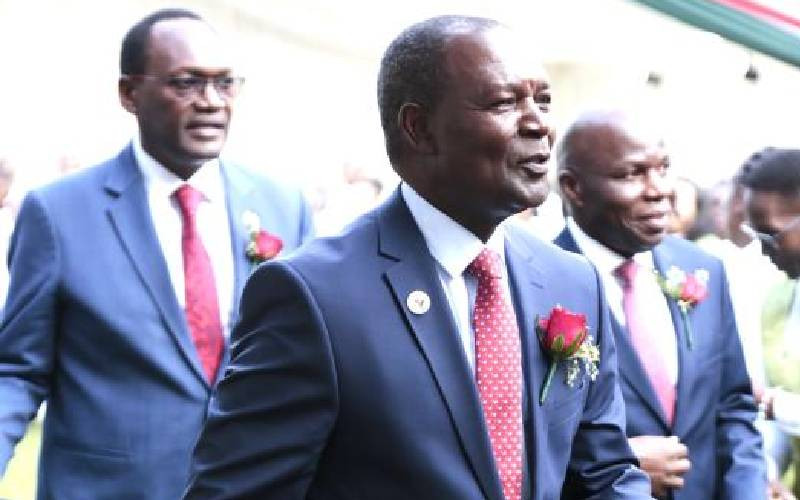

Treasury Cabinet Secretary Njuguna Ndung'u, while presenting the National Budget, emphasised the government's commitment to reducing reliance on commercial borrowing and exploring a variety of financing options.