×

The Standard e-Paper

Fearless, Trusted News

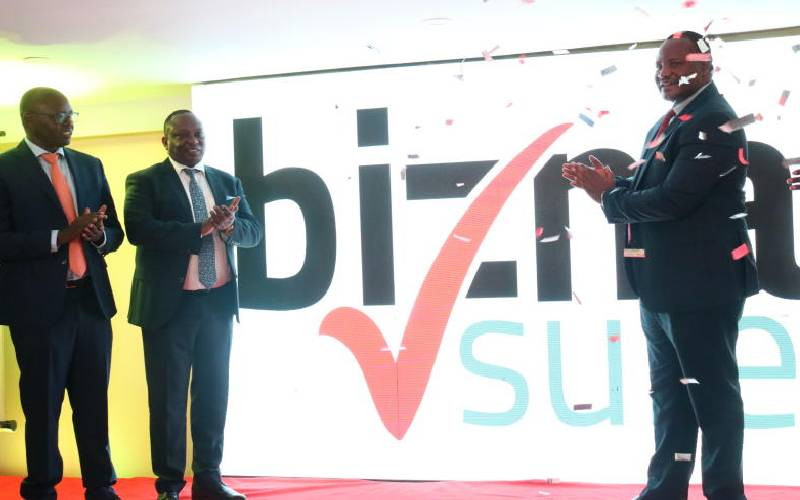

On Thursday last week, Minet Kenya, in partnership with Fidelity Insurance unveiled a business cover for Small and Medium Enterprises(SMEs).

The cover targets business owners with an all-in-one package insuring them against risks such as breakdown of machinery, deteriorating stock, money lost in transit, theft, litigation from workers or competitors political violence among others.