×

The Standard e-Paper

Fearless, Trusted News

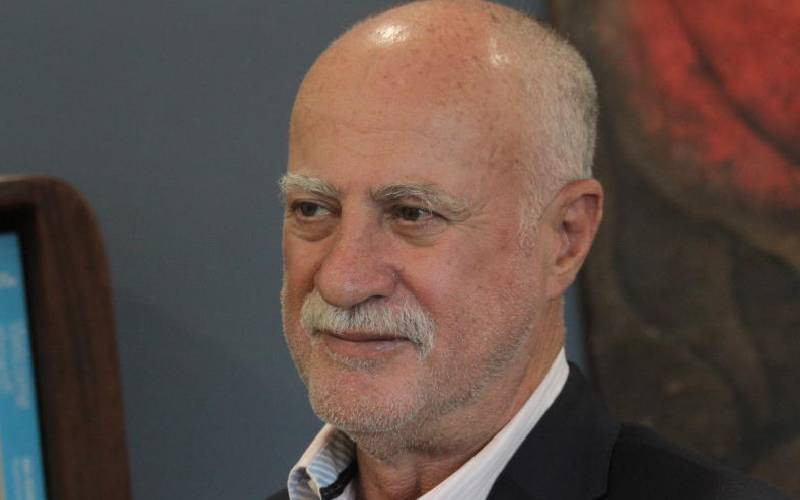

Agriculture insurance start-up Pula has tapped former Safaricom chairman Michael Joseph (pictured) in a similar role.

Mr Joseph, who is also the chairman of Kenya Airways, joins Pula advisors as chairman of its board with immediate effect. "Michael will bring a wealth of skills and industry knowledge to Pula. He has been committed to seeing small businesses in Africa succeed on the global stage," said Pula co-founder and chief executive Thomas Njeru in a statement.