×

The Standard e-Paper

Stay Informed, Even Offline

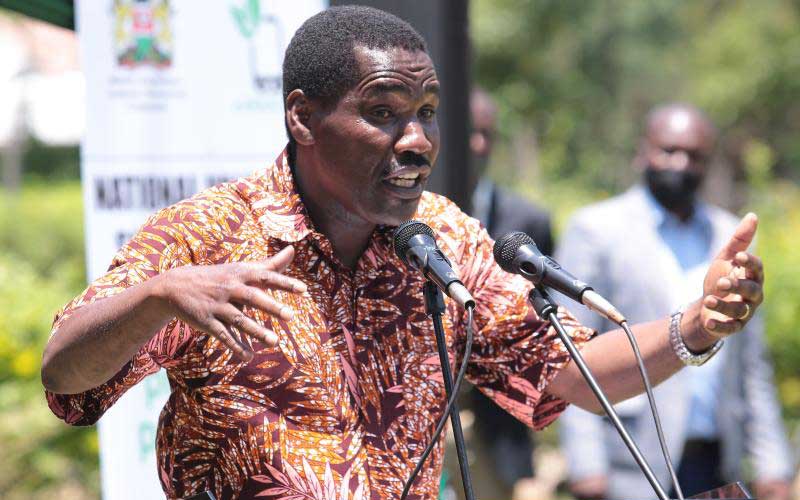

CS Peter Munya. Just months in office, he has already introduced changes aimed at improving farmers’ fortunes and management of sector, and in the process stepped on numerous toes. [File, Standard]

With his signature trimmed mustache, the son of Muthaara village, Meru County, has been known to rock the status quo wherever he goes.