×

The Standard e-Paper

Smart Minds Choose Us

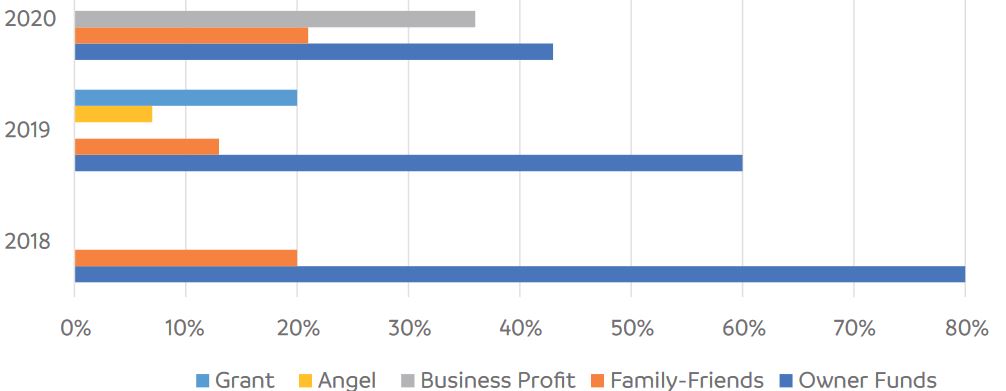

NAIROBI, KENYA: The appetite for bank loans among Small and Medium Enterprises (SMEs) is on a downward trend, a new survey reveals.

Compared to last year, the uptake of bank loans among SMEs declined by 29 per cent in 2020 compared to over 80 per cent witnessed last year.