Investors at the Nairobi Securities Exchange (NSE) will have to wait longer to know the fate of their funds locked in firms suspended from trading.

According to the Capital Markets Authority’s (CMA) quarterly report for the three months ending June this year, a total of six companies out of the 64 listed ones remain suspended from trading.

National carrier Kenya Airways is one such firm as the government negotiates the formulae for nationalising the struggling airline. The same goes for National Bank of Kenya following its takeover by KCB Group last year.

Other firms like Atlas Development and Support Services Ltd, however, face a more uncertain future. The company was one of the success stories when it listed in the Growth Enterprise Market Segment (GEMS) in 2014 as a logistics provider for oil and gas firms.

The company was, however, suspended from the bourse after it failed to publish financial results for subsequent years. Other companies that could be edged out of the bourse in the long-term include Mumias Sugar, Deacons (East Africa) and ARM Cement. All three firms once ruled their respective sectors, but their value has since tumbled down irredeemably.

CMA said new regulations allowing companies to file regulatory disclosures online would go a long way in easing compliance, particularly during the Covid-19 pandemic.

No results

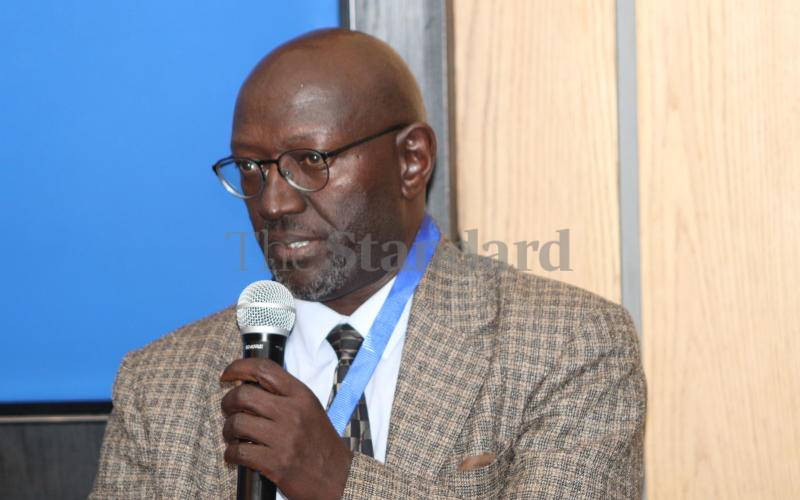

“We are now allowing companies to conduct virtual meetings and relaxing statutory requirements, including filing in newspapers,” explained CMA Acting Chief Executive Wyckliffe Shamiah.

“Now CMA allows companies to upload financial statements on their websites so shareholders can access crucial company information.”

A spot check by the Financial Standard, however, revealed at least 10 companies are lagging behind in their disclosures to investors.

Several of them are yet to publish documents like annual reports and investor briefings dating back to 2018.

Kenya Power, Kenya Electricity Generating Company (KenGen) and Kurwitu Ventures Ltd, for example, are yet to publish their results for the financial year ending June 30, 2019.

Other firms that have faced operational challenges in the recent past like Deacons East Africa, Nairobi Business Ventures, Uchumi, ARM Cement and KenolKobil have also posted no financial results for the 2018 and 2019 financial years.

Deacons was suspended from trading on the Nairobi Securities Exchange and went into administration in November 2018 after it was unable to repay creditors, including banks.

Retail chain Uchumi has had a difficult two years and has delayed publishing its accounts, but CMA is yet to suspend the retailer from trading on the NSE or penalising it.

Stay informed. Subscribe to our newsletter

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.