×

The Standard e-Paper

Home To Bold Columnists

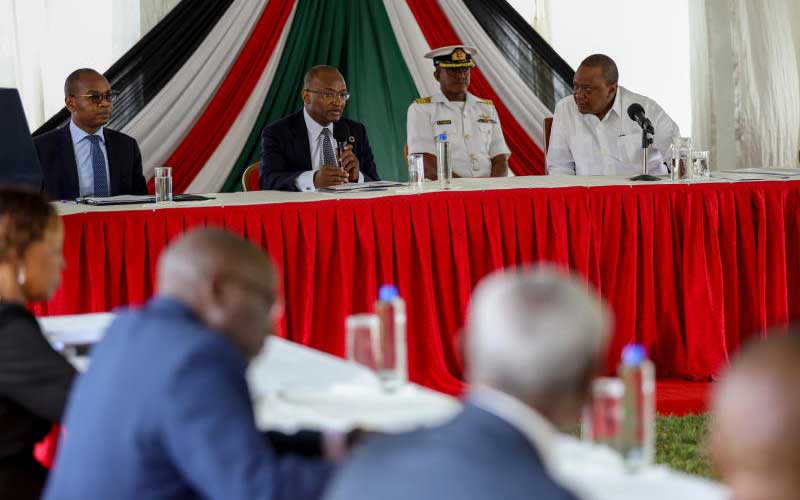

President Uhuru Kenyatta (right) listens to Central Bank of Kenya Governor Patrick Njoroge. CBK said borrowers can negotiate an extension of their loan repayment with banks. [PSCU]

Customers can now engage with their banks to extend their loan repayment for at least one year, the Central Bank of Kenya (CBK) has said.