×

The Standard e-Paper

Smart Minds Choose Us

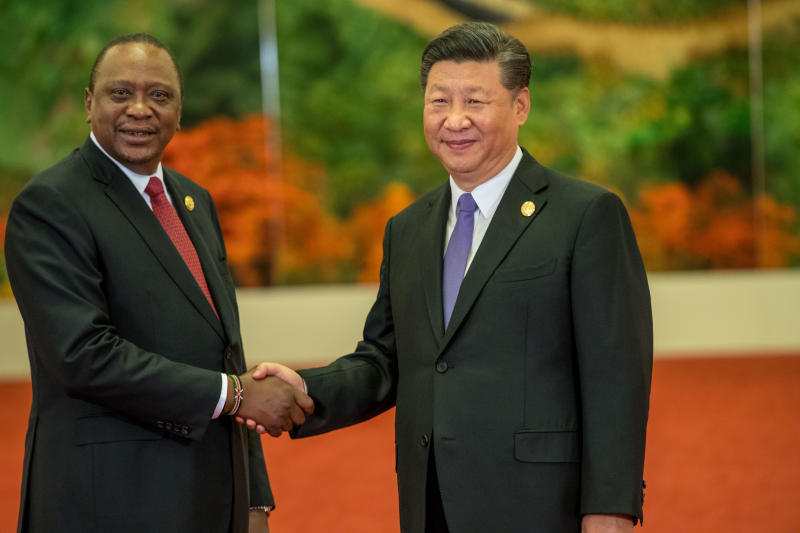

Last week marked a major milestone, or millstone - depending on where one’s seat at the table is positioned - in the country’s relationship with China’s bank managers.

After the latest round of loan talks held in Beijing, Kenya’s debt stock to China crossed the Sh1 trillion mark.