×

The Standard e-Paper

Fearless, Trusted News

Pressure is piling on the government to probe the controversial Sh18 billion duty stamps tender awarded to a Swiss firm by the Kenya Revenue Authority.

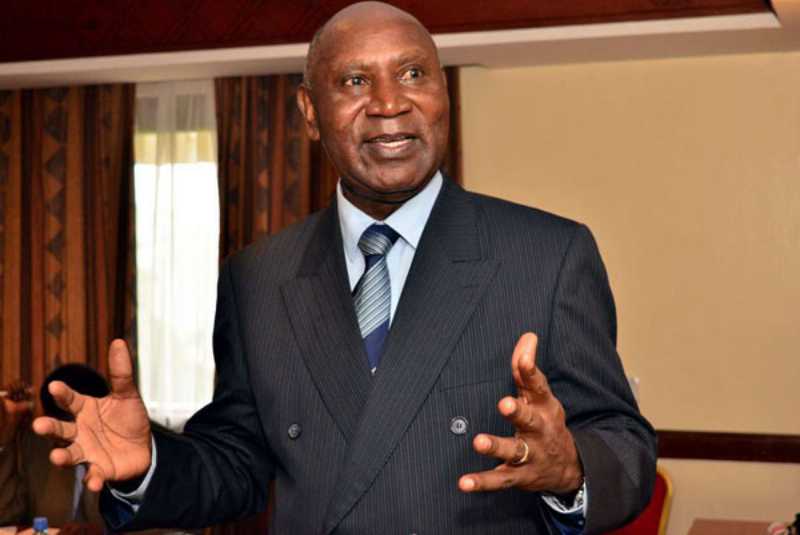

The auditor general Edward Ouko questioned the single sourcing tendency applied by the Kenya Revenue Authority in awarding the Swiss Company SICPA Security Solutions SA Limited the Sh17.7 billion tender.