×

The Standard e-Paper

Fearless, Trusted News

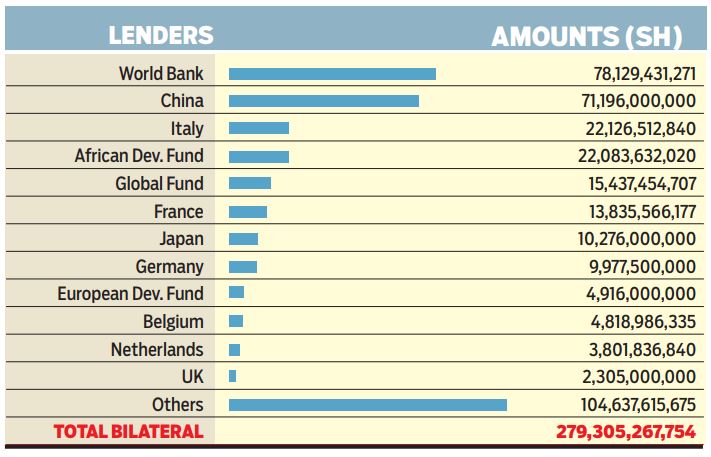

The World Bank and China will fund a chunk of Kenya’s development projects, including the building of roads, railways, hospitals and schools.

The two will contribute more than half, or Sh150 billion, of an estimated Sh280 billion that Kenya expects from external lenders. These funds will come in form of loans and grants.