×

The Standard e-Paper

Smart Minds Choose Us

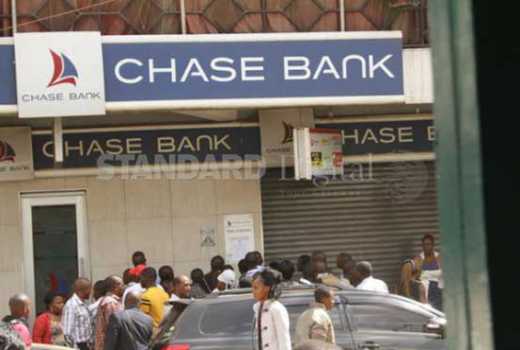

NAIROBI, KENYA: Central Bank of Kenya (CBK) has given Mauritian lender SBM Holding greenlight to acquire troubled Chase Bank.

Central Bank and Kenya Deposit Insurance Corporation (KDIC) on Friday said they have received and accepted binding offer from SBM Holdings with respect to Chase Bank (Kenya) Limited (In Receivership) (CBLR).