×

The Standard e-Paper

Home To Bold Columnists

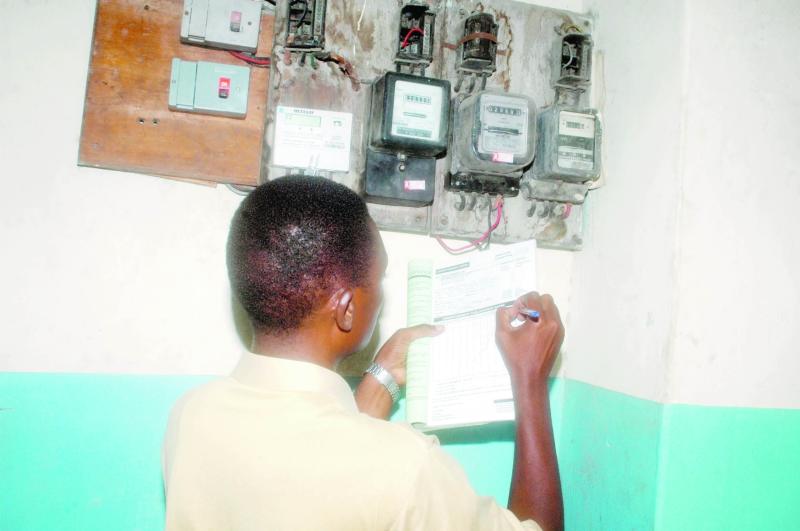

Large power consumers may not benefit from the recently introduced off peak electricity tariff. This is after the energy industry regulator put tough conditions that users have to meet to benefit from the tariff.

According to Energy Regulatory Commission (ERC), industrial electricity users will only be eligible for the discounted off peak power tariff if they can exceed their monthly average consumption.