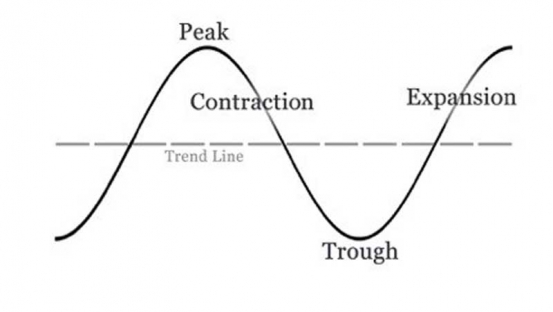

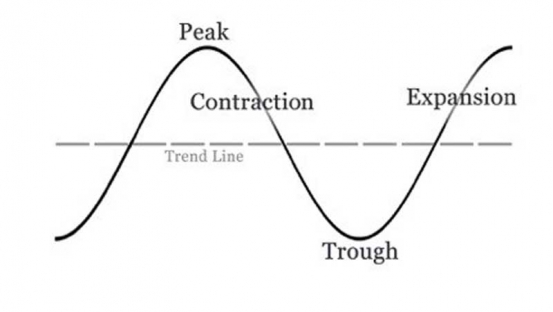

Businesses have a life cycle almost similar to that of living things. From the moment you start your venture, there are bound to be ups and downs that affect its performance. Market conditions such as regulation and competition ensure that you do not have free rein in selling your product or service, but may also energise your business by forcing you to innovate.

The life cycle starts when an entrepreneur recognises an opportunity, sets aside resources, implements the idea then assumes the risks and rewards. Whereas many enterprises will follow different paths, it is important to keep in mind that your business may not live for ever, and that it is bound to undergo numerous changes over time. A survey by the Kenya National Bureau of Statistics in 2016 found that 2.2 million micro, small and medium enterprises had closed shop since 2011.

On average, businesses were closed at the age of 3.8 years, according to the Kenya Micro, Small and Medium Establishments survey.

Thus for your business to survive, you will need to be flexible and innovative as you adapt to changing environments.

Here are the typical stages that your enterprise is likely to go through.

1. Recognition of opportunity

The idea to start a business usually comes from different motives. You may have perceived an economic opportunity or have considered starting a business as a way of increasing your income.

Also, you may have decided to go into business to create employment for yourself after unsuccessfully applying for a job for ages.

At this stage, it’s essential to determine the viability of the idea through market research. Most people fail to proceed past this step.

2. Commitment of resources

Upon establishing that the business idea is workable, this stage involves developing the business plan, sourcing for capital, registration of the business, and scouting for a location. Basically, all things that are necessary to start operation are done at this stage. Depending on the funds required, you could start with savings that you might have put aside, or borrow from various sources such as a bank, relatives or friends. There are also investors who put their money in a commercial venture in return for a share of the business.

3. Market entry

After allocation of the resources, the business kicks into action. The production and distribution of goods or services starts and initial sales are made. Business may be slow at this stage because few people are aware of the company.

However, it mostly slowly begins to pick up as the customer base increases and more awareness is created. You may be entering a crowded market - such as opening a retail shop or eatery - or be an innovator with a totally new idea. Chances are that you will eventually encounter competition.

4. Survival and growth

Stay informed. Subscribe to our newsletter

After a successful launch, the business survives and starts to grow. Although it is still simple, it has demonstrated that it is a functional entity. It has enough customers and can supply them with the required goods and services. Additionally, it’s capable of generating enough cash to stay in business and finance its growth.

You will for investors to expand the business or choose to keep it small as you engage in other activities such as running for political office or starting new ventures. The former can be realized through acquiring resources, differentiation, hiring qualified personnel and expanding into new markets. Additional capital to grow the business may be sought through external financing from banks, family or entering into a joint venture.

5. Prime

At this juncture, your venture is beyond survival and stability.

The business is facing minimal problems and is now big enough to be noticed. It may have different product or service lines and geographical area served by the business has expanded.

Additionally, it may have lost its simple structure. You are no longer solely responsible for decision making and now the business bears the features of a large organisation.

Some entrepreneurs may choose to exit the business at this phase through initial public offering or selling it to a larger company.

The founder may cash out to start other ventures. Notably, maturity can only be achieved through effective business management and strategies.

To maintain this stage, you need have continuous innovations and new venture strategies. You should not allow ineffective management or environmental changes to affect the operations of your business.

6. Decline or death

The decline of the company is brought about by factors such as competition, changes in business environment, new regulation and technology that disrupts the industry. For example, the ban on plastic bags could affect companies that manufacture plastic bags hence lead to their decline.

To reduce external interference that may lead to the slowdown of your business, you should always do SWOT analysis to ascertain its health.

This will allow you take proactive measures to eliminate weakness and threats. A business may die when it is unable to sustain competition or when the owner dies. Most small businesses don’t outlast their owners. Not all entrepreneurial life cycles follow this path, but your business must go through most of the stages above. Understanding these phases will help you deal with the existing challenges and prepare you to get around challenges that may arise in future.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.