Long considered as East Africa’s manufacturing hub, Nairobi is now left tugging on the shorter end of the stick in the scramble for larger Sh41 trillion East African market.

Its earlier dominance in the region has been upended by more powerful forces. Unfortunately, the Government seems to run away from this reality.

The Principal Secretary in the Ministry of East Africa Community Betty Maina thinks Kenya is losing to the new-found industrial players in Rwanda, Uganda, Tanzania and Burundi.

She observed that after an extended period in which Kenya was the main supplier of various manufactured goods to these countries, they too have seen the growth of their own industries.

Once industrial novices, the neighbours can now also manufacture household goods such as cooking oil, margarine, cosmetics, processed milk and sugar, which used to be imported from Kenya.

This, she said, has seen manufactured goods from Kenya to her neighbours decline significantly. Figures from the Kenya National Bureau of Statistics showed total export earnings from the East African Community (EAC) registering a four per cent decline to Sh121.7 billion in 2016 from 126.7 billion in 2015.

But the former Kenya Association of Manufacturers chief executive to some degree, chose to be economical with the truth.

Conspicuous in the crowd she was addressing was a delegation of investors from China - one of the countries that by and large are responsible for Kenya’s trade loss in the EAC.

More than 40 Chinese investors had gathered at Boma Hotel in Eldoret town, Uasin Gishu County, for a dinner party that had been hosted by the county Governor, Jackson Mandago.

Industrialised nation

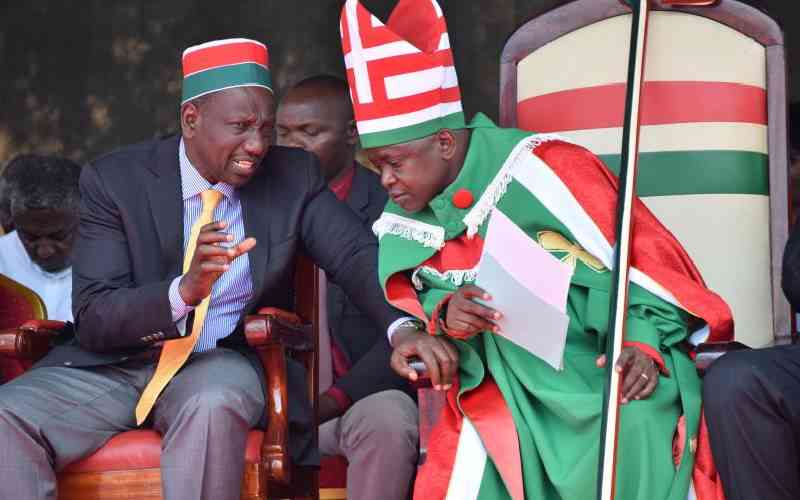

President Uhuru Kenyatta was expected to unveil Kenya’s first privately-owned special economic zone (SEZ) that could transform the country into an industrialised nation by 2030.

He was, however, represented by his Deputy William Ruto. It appeared the Chinese were going to be critical in the attainment of this goal - a situation that Ms Maina could not have wished to jeopardise.

She might have chosen to conceal the real reason for Kenya’s dramatic descend into economic insignificance in the region.

China and India - not Uganda, Tanzania, Rwanda and Burundi - are responsible for Kenya’s trade decline in the region.

China’s entry into Kenya has been even tectonic, with the Asian country taking up 34 per cent of Kenya’s import bill while India accounting for 18 per cent, bring their total to 52 per cent. This compared to 2000 when imports from both China and India together took up only 8.3 per cent.

Stay informed. Subscribe to our newsletter

If anything, Kenya is far ahead of her EAC peers in terms of industrialisation, and it will be long before manufacturers in these countries give their Kenyan counterparts a run for their money, according to economist, Dr Scholastica Odhiambo.

“Competition is going to come from China and India which can make their products so cheap,” says Dr Odhiambo.

The fact is that Kenya’s old and rickety factories have been no match to efficient manufacturers in China and India who have churned out an assortment of products that are five times cheaper and better quality than Kenya’s. Chinese manufacturers have not only beaten their Kenyan counterparts in the region but also in the latter’s own turf.

Several Kenyan manufacturers have crumbled under the heavy weight of cheap Indian and Chinese products which have flooded the market, putting tens of thousands jobs on the line as well as job cuts due to closure of some local industries.

But it is in the other four East African countries that Kenyan manufacturer’s coup de grace has not attracted as much talk, albeit the rout is worrying.

A local dealer in steel says Kenyan steel makers who once supplied the region with most of the commodity have been left to scramble for the small Kenyan market. Even in Kenya, there was hue and cry last year after cheap Chinese steel poured into the country, forcing many steel manufacturers out of business, even as others laid-off workers in droves.

The Economic Survey 2017 attributed the decline in Kenya’s export earnings in the region to contraction of exports to Uganda and Rwanda by 9.3 and 2.5 per cent respectively.

“Some of the commodities that recorded declines in export earnings from Uganda included cement (34.7 per cent); petroleum oils (27.4 per cent); articles of plastics (29.0 per cent); soap, cleansing and polishing preparations (32.1 per cent); alcoholic beverages (28.2 per cent); and salt (12.0 per cent),” read the survey. Now, Financial Standard has gleaned through the figures in the Observatory of Economic Complexity, an online resource for international trade data and economic complexity indicators.

It has found a graphic visualisation of how China and India have in the last 10 years voraciously eaten into Kenya’s trade pie across the region, leaving it with crumbs.

There seems to be a re-organisation in trade relations, which has seen the other East African member states, over the time, trade more with each other but less with Kenya in what some see a conspiracy by Kenya’s neighbours to tame its inflated ego. This has left Kenya, for long the cornerstone of the EAC, isolated.

As Kenya’s exports into the region slump, imports into the EAC market from the two Far East countries have shot up, indicating a correlation between Kenya’s loss and the two Asian giants’ gains.

A 2016 working paper by the World Bank noted that China’s foray into the region might have hurt Kenya’s exports into the four East African countries.

The paper, Deal or No Deal: Strictly Business for China in Kenya?. It noted that Kenya’s exports to Uganda and Tanzania were falling. “Chinese goods may have also hurt Kenya’s exports to its neighbours.

Exports to Tanzania and Uganda are quite similar to China’s, compared to both countries’ exports to the United States or the UK,” read the report written by the World Bank’s Lead Economist for the Russian Federation Apurva Sanghi and Dylan Johnson - consultant in the Macroeconomics and Fiscal Management Global Practice in Nairobi.

Kenyan exports

The greater overlap in East Africa suggests that Chinese goods will likely displace Kenyan exports. Between 2008 and 2014, manufacturing exports to Tanzania fell 36.1 percent; exports to Uganda increased slightly by 4.5 percent, but compared to previous years, the growth was slow.”

In 2000, Kenya’s exports to Uganda accounted for 29 per cent of Uganda’s total import bill which added up to $284 million (Sh29.2 billion).

India’s and China’s products accounted for a paltry 5.4 per cent and 2.8 per cent respectively, trailing even that of the United Kingdom (8.1 per cent) and Japan’s (6.2 per cent).

But this changed fifteen years later as India and China by-passed Kenya to become Uganda’s first and second source of imports.

India’s imports into Uganda accounted for 20 per cent of Kampala’s total import bill while China’s accounted for 16 per cent. The two Far-East countries had eaten into Kenya’s pie leaving Nairobi with a small share of 9.7 per cent, although the country’s import value went up to $535 million (Sh55 billion).

In Rwanda, Kenya’s share of exports reduced by more than half from 16 per cent to 7.5 per cent, even as China’s imports into Kigali increased almost ten-fold from 2.4 per cent to 18 per cent. Imports from India also rose five times from 2.1 per cent to 10 per cent. Interestingly, Rwanda’s trade with Uganda and Tanzania deepened as that with Kenya went down. Imports from Tanzania into Rwanda rose from a paltry 1.3 per cent 15 years ago to 5.1 per cent in 2015.

Uganda’s share of imports to Kigali went up from 6.5 per cent to 12 per cent, in what many might see as re-organisation of relations amongst the East African countries.

But Kenya’s worst performance has been in Tanzania, whose diplomatic relations with Nairobi has in recent times plunged. From being the fourth position and commanding a 6.1 per cent share in Tanzania’s import bill, Kenya’s exports into Dares Salaam have plunged significantly leaving the country at 8th position in the log with a minuscule share of 1.6 per cent.

Dr Odhiambo says Tanzanian membership in South African Development Community has also seen its retail stores stock more consumer goods from South Africa- goods that would ordinarily been Kenyan.

Meanwhile, imports from China and India, though trailing those from Saudi Arabia from where the East African country gets its refined petroleum, have risen significantly from 4.4 and 5.4 per cent in 2000 respectively to 15 per cent and 8.3 per cent respectively in 2015.

The exception is the war-torn Burundi where the share of imports from Kenya went up from 5.1 per cent in 2000 to 2015. But even here, China’s and India’s foray have been significant. Share of imports from India into Burundi went up from 3.5 per cent to 11 per cent while China’s grew from four per cent to 13 per cent.

Gone are the days when it was only shrewd Kenyan importers who knew how to get products from China and India, repackage them and then re-export to the neighbouring countries.

In fact, what Kenya can do, its neighbours can do better. Dr Odhiambo says Uganda’s importation regime is better than Kenya’s in that Kenyan importers have been using Uganda to get products into Kenya. “Chinese have been aggressive, landing containers in Uganda through the cargo plane. So much that even now our traders go to Kampala to get goods, as Kampala has a better importing edge than Kenya,” says Odhiambo.

Moreover, although the East African Community has been one of the success stories of Africa’s elusive trading blocks, divergent political interests have frustrated the fine operation of common market protocol which is supposed to allow for easier movement of goods and services, labour and capital.

Tanzania, for example, went against the EAC Protocol and introduced work permit of around $3,000 (about Sh300,000), a decision that might have hurt Kenya’s investment into the country.

Infant industries

Dar es Salaam’s recent increase of import duties on sugar, paper and furniture in what President John Magufuli believes is the way to protect infant industries might hurt Kenya too. But it is the Chinese aggressiveness that has ensured Kenya’s waterloo in the region is clinical. With its deep pockets, China has enticed African countries with incentives to build their infrastructure.

Although funds have not come with the typical Western conditions of transparency and democracy, the recipient of these funds have had to open up their markets to Chinese-manufactured goods, explains Dr Odhiambo.

This is a lifeline for the world’s second largest economy, whose market is already saturated. And it looks like Kenya has resigned to this fate. Following the rout in the region, Kenya has decided to work with, rather than against, its vanquisher. In its effort to reboot its manufacturing sector and regain lost ground in the East Africa market, the country has turned to the Special Economic Zones.

Enterprises under the SEZ will enjoy preferential treatment in what the Government hopes will help them concentrate on improving their production.

But who will do it?

The 40 Chinese investors at the dinner event that was being addressed by Ms Maina were interested in the AEZ Pearl Africa, an industrial park that broke ground last week.

The project is being done by a local firm Africa Economic Zone Ltd and a Chinese company, Guangdong New South Group.

The project managers have their eyes fixed on the EAC market with a market base of over 160 million people, which Ms Maina believes Kenya can still recapture by doing more value addition.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.