×

The Standard e-Paper

Fearless, Trusted News

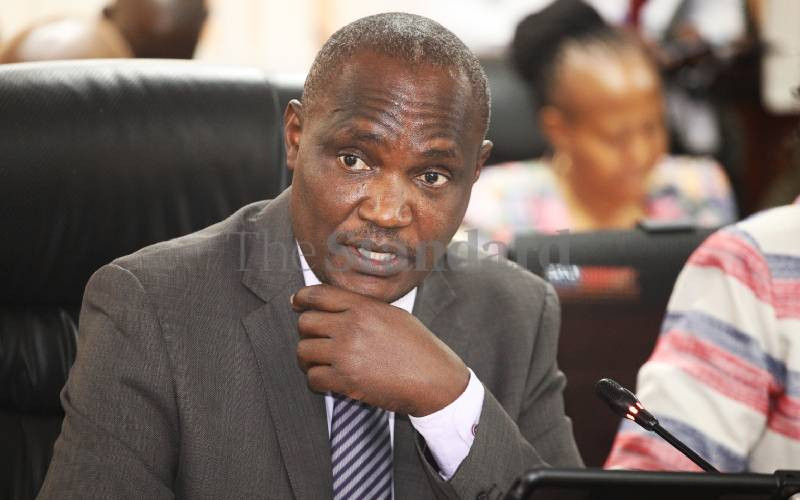

National Treasury and Economic Planning Cabinet Secretary John Mbadi has laid bare the challenges facing revenue collection, detailing that some of the taxman's systems are not working optimally.

The CS, who was speaking during the ongoing Kenya Revenue Authority (KRA) Summit 2024 in Nairobi, yesterday, listed iTax and the iCMS (Integrated Customs Management System), as some of the systems that are either outdated or not working as they should.