×

The Standard e-Paper

Fearless, Trusted News

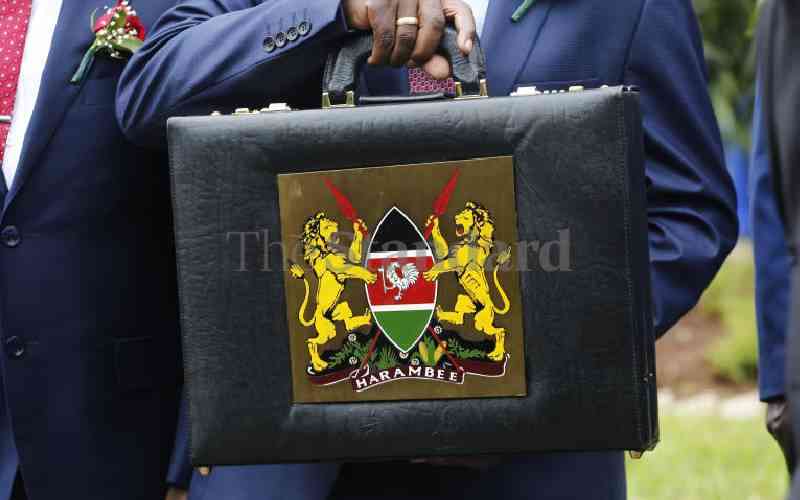

Tomorrow is Budget Day and it closes Budget Week. Thanks to our courts, it has also been Finance Bill week.

This piece is written with the understanding that the Budget (our spending side) is pretty much done after last week's National Assembly Supply Committee debate on proposed appropriations for the 2024-25 fiscal year.