×

The Standard e-Paper

Smart Minds Choose Us

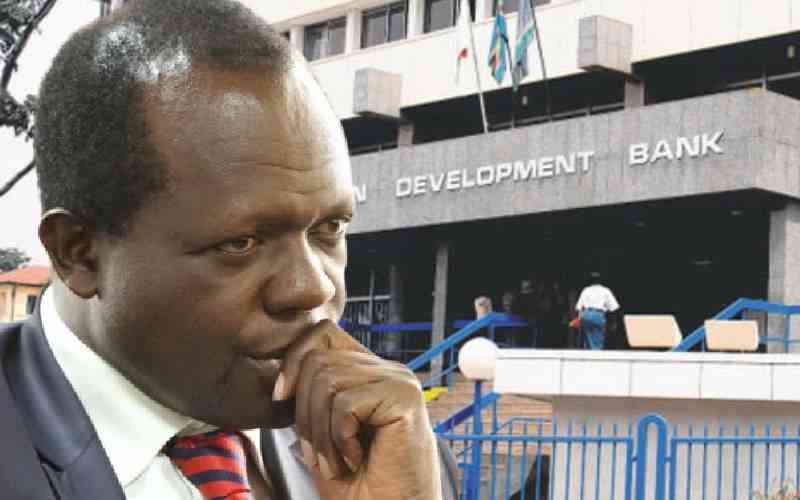

The Sh1.5 billion loan battle between former foreign affairs minister Raphael Tuju and East African Development Bank (EADB) has been among the major commercial battles in courts this year.

With Justice Afred Mabeya setting March 7, 2024 as the hearing date for Mr Tuju's fresh bid to salvage his company, Dari Ltd, from takeover by EADB, the dispute that started in England is set to give another legal round of thrill.