×

The Standard e-Paper

Fearless, Trusted News

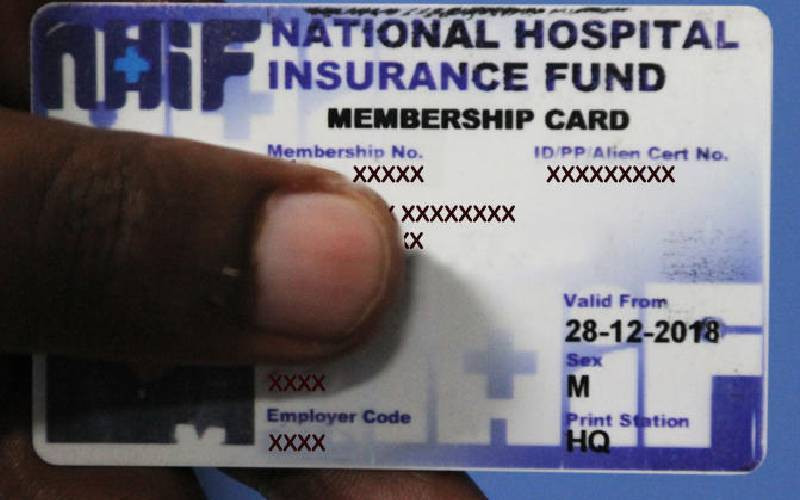

The attainment of Universal Health Coverage (UHC) remains one of the key pillars of President Uhuru Kenyatta’s Big Four Agenda, with several strategies being put in place by the government to ensure its realisation.