×

The Standard e-Paper

Stay Informed, Even Offline

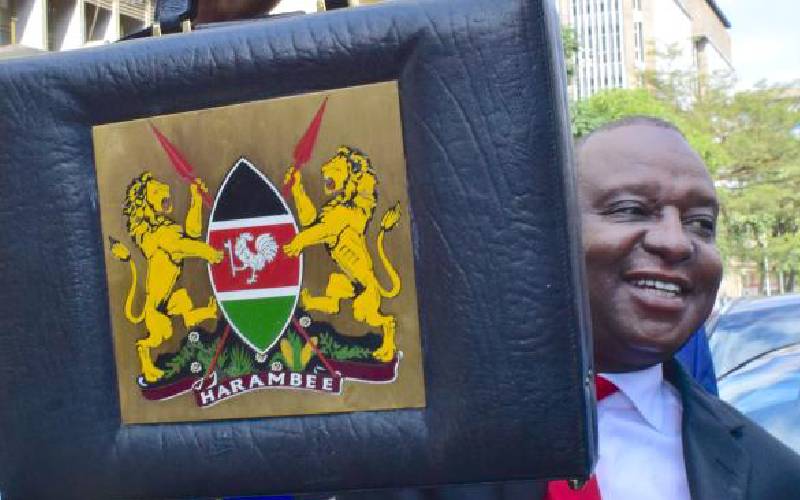

National Treasury CS Henry Rotich at the Treasury building on June 24, 2018. [File]

Government agencies, ministries and county governments should brace up for leaner budgets, as the State grapples with an imminent shortfall in expected revenues against higher spending needs.