×

The Standard e-Paper

Fearless, Trusted News

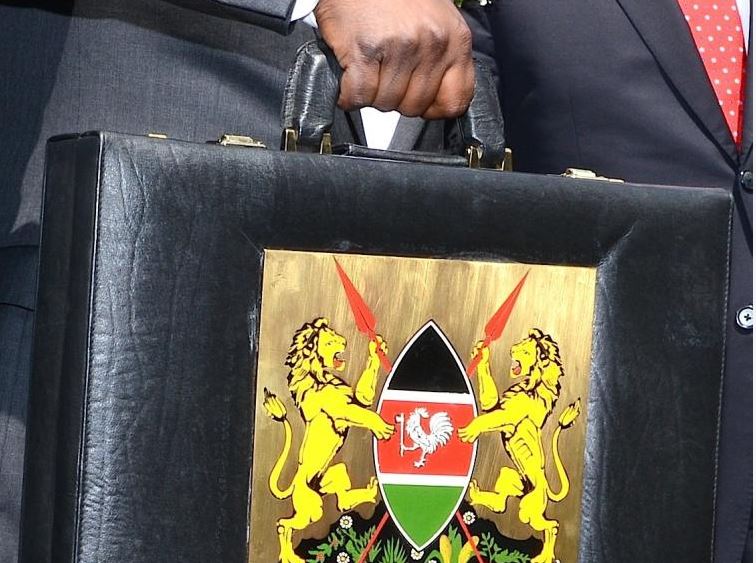

When he served as Finance Minister in 2009, President Uhuru Kenyatta was summoned by Parliament to explain a Sh9.2 billion error in the Supplementary Budget.

Challenged by hawk-eyed MPs on the discrepancy which affected over 200 items, the President blamed the mishap on a ‘computer error.’