The International Monetary Fund (IMF) has once again given a disturbing assessment of the country’s economy.

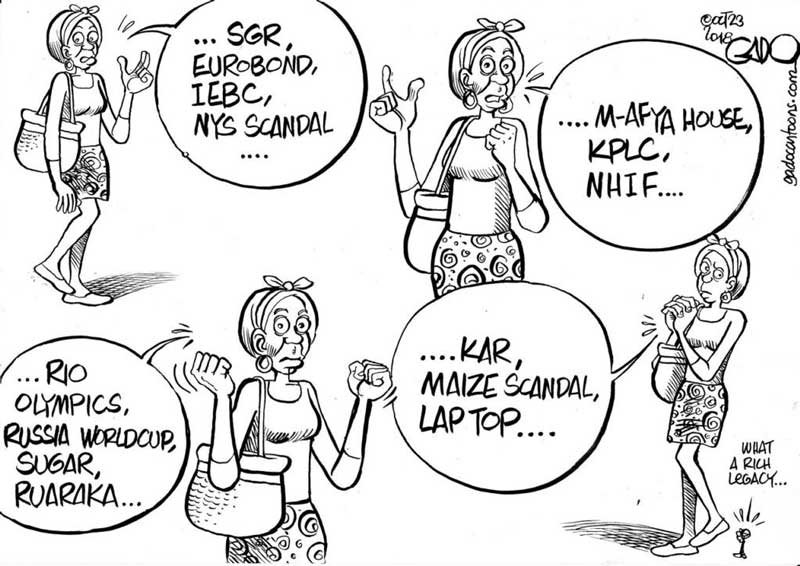

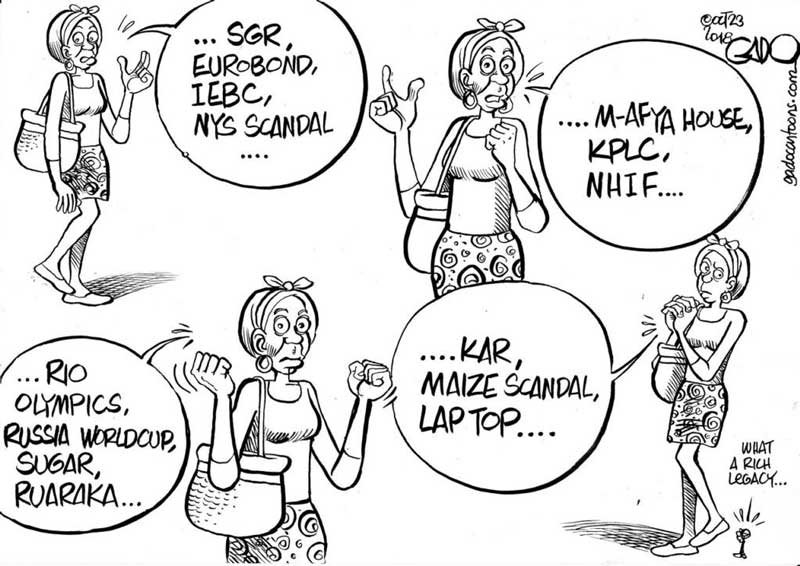

In one of its latest reviews on Kenya’s economic outlook, the IMF noted that Kenya was now more likely to experience difficulties in repaying its debts, an indictment on President Uhuru Kenyatta and all those he tasked with managing the economy.

While we do not want to be seen shouting fire in a crowd, the position of this newspaper has been that we are flirting with fate, and if nothing is done, this country will descend into a financial crisis. With such an eventuality, the next generation will be left with nothing to inherit but a scorched earth.

IMF traces the current predicament to binge-borrowing that was perfected by the current Government. When Jubilee Party swept to power slightly over five years ago, it talked about infrastructure Interestingly, the Government borrowed expensive, short term loans for long-term projects.

“The higher level of debt, together with rising reliance on non-concessional borrowing, have raised fiscal vulnerabilities and increased interest payments on public debt to nearly one-fifth of revenue,” said IMF.

Suddenly, and especially after the country was ranked a little richer than its neighbors by joining the league of low middle income countries, the share of the country’s expensive commercial loans like the Eurobond increased dramatically.

However, cheap loans from global partners declined. Soon, as most of the external loans in US dollars matured, Kenya was forced to borrow so as to offset the maturing debts- what is known as refinancing. IMF warned that the country might experience refinancing risks, particularly if the shilling weakened and the country’s export earnings did not improve.

While the shilling has held on steady against the dollar, trading at an average of 101 against the Greenbuck, Kenya’s exports have barely improved. Moreover, the shilling is going to come under extreme pressure as the global prices of oil rise, more so with the sanctions against Iran set to take effect on November 5.

The economy has hurtled closer to a precarious position, and any of these disturbance would see the country experience difficulties in repaying its external debt.

A person who cannot repay their debt when it is due is simply bankrupt, and no one wants to do business with a bankrupt individual. Yet this is where Kenya is headed- into bankruptcy.

President Uhuru Kenyatta who is keen on cementing his legacy cannot afford to let the economy go to the dogs. He should act swiftly by cutting on wastage and putting money on projects which are of critical importance to Kenyans. The IMF put it better:

"reducing the fiscal deficit over the medium term, restricting borrowing to finance projects with high social and economic returns, and lengthening the maturity of non-concessional borrowing are essential to limit and eventually reverse the rise in public debt ratios, ace refinancing risks."

Although what led to the dire situation are not of Mr Kenyatta’s making, a lot had to do with what seemingly was a lack of willingness to act on brazen theft and wastage, and a general misalignment of resources for economic progression.

Wisely, Mr Kenyatta has sought to ensure that resources are not only used prudently and in projects that guarantee maximum returns, he has waged a spirited fight on corruption, which if sustained, will save the country's resources from being wasted or stolen.

Stay informed. Subscribe to our newsletter

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.