×

The Standard e-Paper

Smart Minds Choose Us

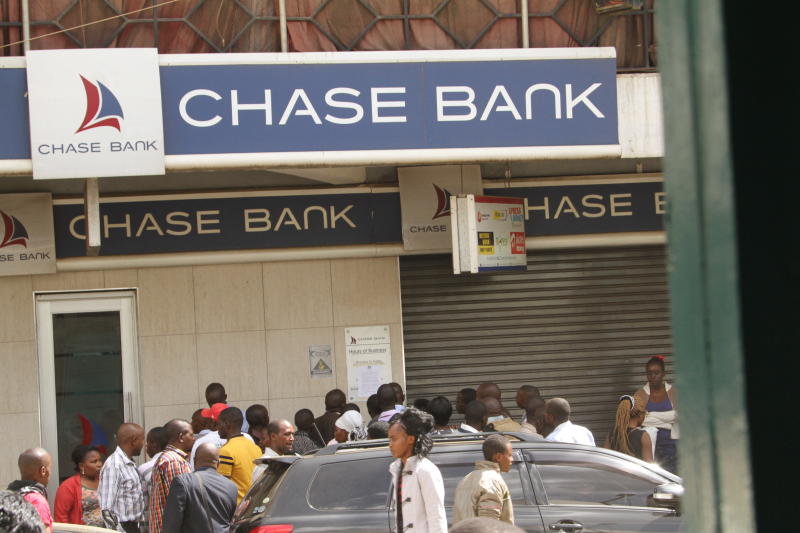

Chase Bank staff are a worried lot despite being assured that majority of the 700 plus workforce will be absorbed by the State Bank of Mauritius (SBM).

SBM has only rejected 34 workers after the lender issued letters to employees this week but has put all of them under a six-month probation.