×

The Standard e-Paper

Join Thousands Daily

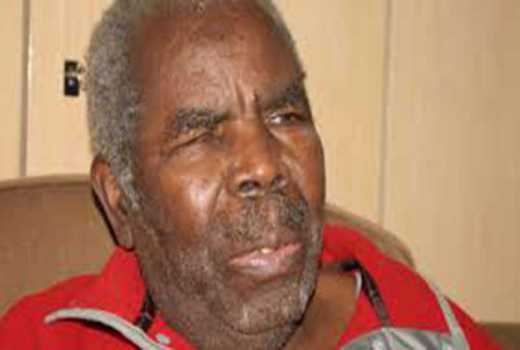

The estate of tycoon Gerishon Kirima owes the Kenya Revenue Authority Sh632 million in taxes.

In his latest report, the Auditor General, Edward Ouko, queries why KRA has failed to collect the dues in spite of demand notices and negotiations.